Contract of Guarantee – Indian Contract Act, 1872 – Law Notes

Introduction

Contract of Guarantee comes under Special kind of Contracts i.e. Section 126- 147 of the Indian Contract Act, 1872

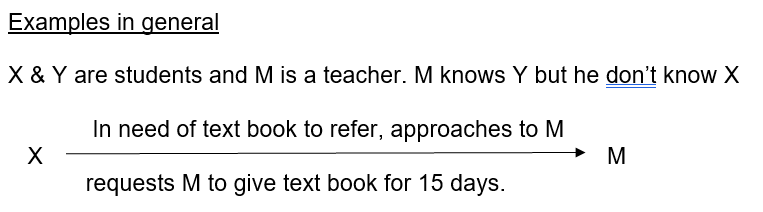

M refuses to give the book saying I don’t recognise you what is the guarantee that you will return the book

X gives reference of Y and M contacts Y asking about the guarantee that whether ‘X’ will return the book.

Two possibilities :

- Y says M that he takes the guarantee that X will return the book and if X doesn’t return, I will see that, he will return the book.

- Y says M that he takes the guarantee that X will return the book and if X doesn’t return, I will pay you the cost of book or I will purchase a new book and will give it to you.

“Contract of guarantee”, “surety”, “principal debtor” and “creditor” (Section 126)

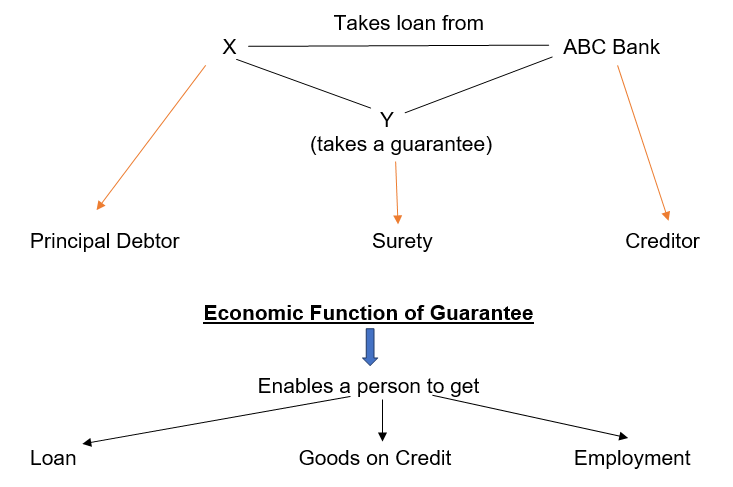

A “contract of guarantee” is a contract to perform the promise, or discharge the liability, of a third person in case of his default. The person who gives the guarantee is called the “surety“, the person in respect of whose default the guarantee is given is called the “principal debtor“, and the person to whom the guarantee is given is called the “creditor“. A guarantee may be either oral or written.

Example : X takes loan from ‘ABC’ bank where Y takes the guarantee to pay the loan amount on default of payment by X

Some person comes forward and tells the lender, or the supplier or the employer that, he (the person in need) may be trusted and in case of any default, “ I undertake to be responsible”. Means, there must be conditional promise to be liable on the default of principal debtor( Collateral Liability ).

Consideration for guarantee (Section 127)

Like every other contract, a contract of guarantee should also be supported by some consideration. But there need not be direct consideration between the surety and the creditor. Section 127 says that anything done, or any promise made, for the benefit of the principal debtor, may be a sufficient consideration to the surety for giving the guarantee.

Illustrations

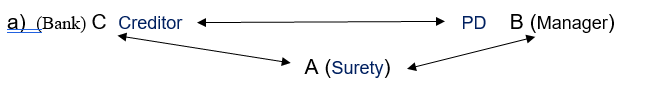

(a) B requests A to sell and deliver to him goods on credit. A agrees to do so, provided C will guarantee the payment of the price of the goods. C promises to guarantee the payment in consideration of A’s promise to deliver the goods. This is a sufficient consideration for C’s promise.

In above case, Consideration to C = A’s Promise

Consideration to A = C’s Promise.

(b) A sells and delivers goods to B. C afterwards requests A to forbear to sue B for the debt for a year, and promises that, if he does so, C will pay for them in default of payment by B. A agrees to forbear as requested. This is a sufficient consideration for C’s promise.

In above case, A sells & delivers goods to B and subsequently B fails to pay C requests A to forbear to sue B for a year & takes guarantee A agrees as per the promise of C

(c) A sells and delivers goods to B. C afterwards, without consideration, agrees to pay for them in default of B. The agreement is void.

A sales and delivers goods to B

C afterwords , without consideration agrees to pay…. Agreement void.

** A guarantee for a past debt should be invalid.

** The section says that, “anything done…for the benefit of PD. Benefit of PD is sufficient consideration.

** A guarantee for a past as well as future debt is enforceable, provided Some future debt is incurred after the guarantee.

Surety’s liability (Section 128)

The liability of the surety is co-extensive with that of the principal debtor, unless it is otherwise provided by the contract.

Illustration :

A guarantees to B the payment of a bill of exchange by C, the acceptor. The bill is dishonored by C. A is liable not only for the amount of the bills but also for any interest and charges which may have become due on it.

Co-extensive (means equal extent, समव्यापी) : The expression ‘co-extensive with that of the PD shows the maximum extent of the surety’s liability. He is liable for the whole of the amount for which the PD is liable and he is liable for no more.

he only illustration appended to the section says that, if the payment of a loan bond is guaranteed, the surety is liable not only for the amount of loan, but also for any interest and charges which may have become due on it.

Indemnity | Guarantee |

|

|

| 2. To perform the promise or discharge liability of 3rd person in case of his default. |

3. Only one contract | 3. Three contracts |

4. Promisor-primary liable. | 4. PD-primary liable Surety – secondary liable. |

5. For reimbursement of loss. | 5. For the security of creditor |

Illustrations :

A—requests B who is zamindar to employ C for collecting rents of B’s zamindari ‘every month’…….. A takes a guarantee of C.

A—promises B to be responsible to the amount of Rs. 5000/- for the due collection every month and payment by C of those rents.

A’s Consideration = B will appoint C

B’s Consideration = A’s promise to be responsible to Rs. 5000/-

Continuing guarantee (Section 129)

A guarantee which extends to a series of transaction, is called, a “continuing guarantee”.

Illustrations

(a) A, in consideration that B will employ C in collecting the rents of B’s zamindari, promises B to be responsible, to the amount of 5,000 rupees, for the due collection and payment by C of those rent. This is a continuing guarantee.

(b) A guarantees payment to B, a tea-dealer, to the amount of £ 100, for any tea he may from time to time supply to C. B supplies C with tea to above the value of £ 100, and C pays B for it. Afterwards, B supplies C with tea to the value of £ 200. C fails to pay. The guarantee given by A was a continuing guarantee, and he is accordingly liable to B to the extent of £ 100.

(c) A guarantees payment to B of the price of five sacks of flour to be delivered by B to C and to be paid for in a month. B delivers five sacks to C. C pays for them. Afterwards B delivers four sacks to C, which C does not pay for. The guarantee given by A was not a continuing guarantee, and accordingly he is not liable for the price of the four sacks.( This illustration is based on very old English case Kay v. Groves,)

The essence of continuing guarantee is that, it applies not to a specific number of transactions, but to any number of them and makes the surety liable for the unpaid balance at the end of the guarantee.

In Chorley and Tucker the distinction is explained.

A specific guarantee provides for securing of a specific advance or for advances up to a fixed sum, and ceases to be effective on the repayment thereof, while a continuing guarantee covers a fluctuating account and secure the balance.

Question is, if one wants to revoke his continuing guarantee how can he revoke ?

There are two sections in this regard

Revocation of continuing guarantee (Section 130)

A continuing guarantee may at any time be revoked by the surety, as to future transactions, by notice to the creditor.

Revocation of continuing guarantee by surety’s death (Section 131)

The death of the surety operates, in the absence of any contract to the contrary, as a revocation of a continuing guarantee, so far as regards future transactions.

Revocation becomes effective for the future transactions while the surety remains liable for transactions already entered in to.

Liability of two persons, primarily liable, not affected by arrangement between them that one shall be surety on other’s default (Section 132)

Where two persons contract with a third person to undertake a certain liability, and also contract with each other that one of them shall be liable only on the default of the other, the third person not being a party to such contract the liability of each of such two persons to the third person under the first contract is not affected by the existence of the second contract, although such third person may have been aware of its existence.

Illustration

A and B make a joint and several promissory note to C. A makes it, in fact, as surety for B, and C knows this at the time when the note is made. The fact that A, to the knowledge of C, made the note as surety for B, is no answer, to a suit by C against A upon the note.

The section is based upon the principle that, the liability of persons who are primarily liable as joint-debtors is not affected by any arrangement between them as to their libility. Whatever be the arrangement between joint-debtor as to their liability to the creditor, they remain joint-debtor.

“A creditor is not affected by any private arrangement entered into as between his two debtors”.

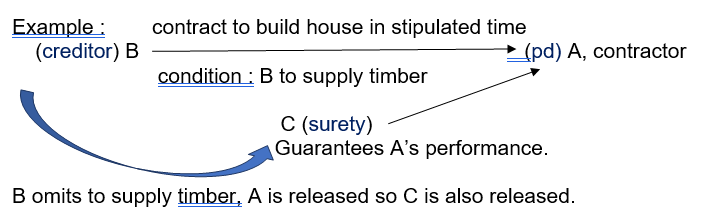

Discharge of surety by variance in terms of contract (Section 133)

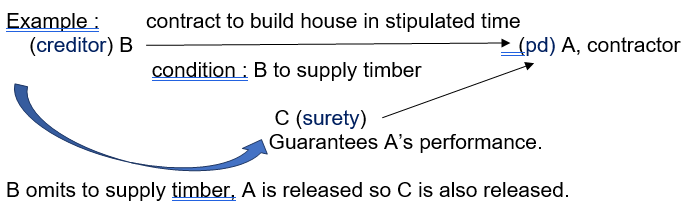

Any variance made without the surety’s consent, in the terms of the contract between the principal debtor and the creditor, discharges the surety as to transactions subsequent to the variance.

Illustrations (Total 5 illustration, a to e).

(a) A becomes surety to C for B’s conduct as manager in C’s bank. Afterwards, B and C contract, without A’ s consent, that B’ s salary shall be raised, and that he shall become liable for one-fourth of the losses on overdrafts. B allows a customer to over-draw, and the bank loses a sum of money.

Afterwards….. there is a contract between B & C without A’s consent. A is discharged because of variance without his consent. (Illustration a is based on the case, Bonar v. Macdonald of 1850)

We can say that the principle behind the section 133 is that, once the contract of guarantee is finalised, and subsequently any material alterations are made by creditor and principal debtor amongst themselves without the knowledge of surety, surety is discharged.

Discharge of surety by release or discharge of principal debtor (Section 134)

Afterwards B unable to pay loan, gives ‘A’ his property worth Rs. 1L PD is discharged from his liability so the surety is also discharged from his liability. (refer section 128 : liability of surety is co-extensive with that of PD. If PD is discharged, surety is also discharged).

Sec 134 : The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

Illustrations (3 illustrations are there in this section)

This section provides for two kinds of discharge from liability :

i) Release of principal debtor : If the creditor makes any contract with the principal debtor, by which the principal debtor is discharged, surety is also discharged. Any release of principal debtor is a release of surety also.

ii) Act or Omission : Any act or omission the legal consequence of which is the discharge of the pd., the surety would also be discharged.

Maharashtra SEB v. Official Liquidator (SC1982) :

“ Where the principal debtor is discharged, by the operation of insolvency laws or, in the case of company, by the process of liquidation, that does not absolve(free) the surety of his liability.

Discharge of surety when creditor compounds with, gives time to, or agrees not to sue, principal debtor (Section 135)

A contract between the creditor and the principal debtor, by which the creditor makes a composition with, or promises to give time to, or not to sue, the principal debtor, discharges the surety, unless the surety assents to such contract.

Ushadevi v. Bhagwan Das : “The creditor has no right, it is against the faith of his contract, to give time to the principal even though manifestly(clearly) for the benefit of surety, without the consent of the surety”.

Surety not discharged when agreement made with third person to give time to principal debtor (Section 136)

Where a contract to give time to the principal debtor is made by the creditor with a third person, and not with the principal debtor, the surety is not discharged.

Illustration : C, the holder of an overdue bill of exchange drawn by A as surety for B, and accepted by B, contracts with M to give time to B. A is not discharged.

Ushadevi v. Bhagwan Das : A unilateral extension of time without any contract with the principal debtor does not discharge the surety. At the best it is a forbearance (refraining from acting) to sue.

Creditor’s forbearance to sue does not discharge surety (Section 137)

Mere forbearance on the part of the creditor to sue the principal debtor or to enforce any other remedy against him, does not, in the absence of any provision in the guarantee to the contrary, discharge the surety.

Illustration

B owes to C a debt guaranteed by A. The debt becomes payable. C does not sue B for a year after the debt has become payable. A is not discharged from his suretyship.

But suppose the forbearance continues up to the expiry of the period of limitation then what ?

For answer, refer section 134 : The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

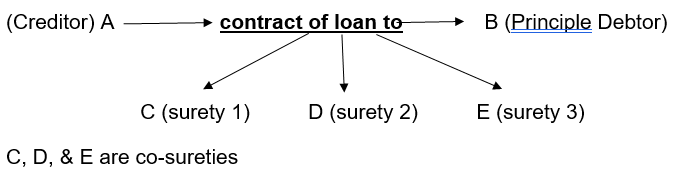

Release of one co-surety does not discharge others (Section 138)

Section 138 : Where there are co-sureties, a release by the creditor of one of them does not discharge the others neither does it free the surety so released from his responsibility to the other sureties.

Sri Chand v. Jagdish Pershad Kishan Chand :

The creditor may at his will release any of the co-sureties from his liability. But that will not operate as a discharge of his co-sureties. However, the released co-surety will remain liable to the others for contribution in the event of default.

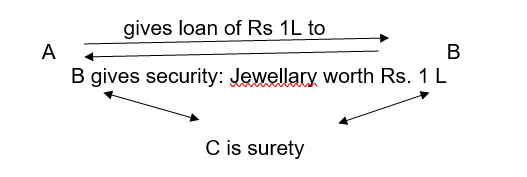

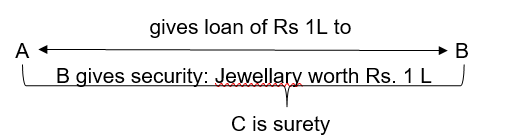

Discharge of surety by creditor’s act or omission impairing surety’s eventual remedy (Section 139)

Example in general

A, before the final payment is made gives back the jewellery to B. B makes default in payment. C can claim discharge from liability.

A surety is entitled after paying off the creditor, to his indemnity from the principle debtor. So it is the plain duty of the creditor not to do anything inconsistent with the rights of the surety.

In above case ‘A’ has impaired surety’s remedy, so as per section 139, he is discharged from his liability.

Section 139 : If the creditor does any act which is inconsistent with the right of the surety, or omits to do any act which his duty to the surety requires him to do, and the eventual remedy of the surety himself against the principal debtor is thereby impaired, the surety is discharged.

Three illustrations appended to section 139.

State Bank of Saurashtra v. Chitranjan Rangnathan Raja (1987 SC) :

A bank could not take sufficient care of the contents of a godown pledged to it against a loan and consequently they were lost, the surety, who guaranteed the loan, was allowed by the SC to claim discharge from liability to the extent of value of the lost goods.

Rights of surety on payment or performance (Section 140)

Subrogation : It means substitution of one person or thing for another

Sec 140 Where a guaranteed debt has become due, or default of the principal debtor to perform a guaranteed duty has taken place, the surety upon payment or performance of all that he is liable for, is invested with all the rights which the creditor had against the principal debtor.

Rights before payment : The Calcutta HC examined this possibility in a case where, the surety found that the amount having become due, the ‘pd’ was disposing of his personal properties one after the other. Surety sought a temporary injuction to prevent the ‘pd’ from doing so.

Surety’s right to benefit of creditor’s securities (Section 141)

Example in general

- In case of default of payment by B, C, being surety pays off Rs 1 L …he has right to get the security in the form of jewellery from A.

- Surety C doesn’t know about this security then also he has a right to know the existence of such security.

- If A loses (lost) jewellery worth Rs 50,000/= or if he gives back jewellery worth Rs 50,000/= back to B, without the consent of surety, C then the surety C is discharged from the liability of Rs 50,000/=

Section 141 : A surety is entitled to the benefit of every security which the creditor has against the principal debtor at the time when the contract of suretyship entered into, whether the surety knows of the existence of such security or not; and if the creditor loses, or without the consent of the surety, parts with such security, the surety is discharged to the extent of the value of the security.

Illustrations : 3 illustrations are appended to this section.

Section 142 & Section 143 :

Concealment : Suppression of, or neglect to communicate, a material fact within the knowledge of one of the parties which the other has not the means of knowing, or not presumed to know

Or its “ the intentional suppression of truth or fact known to the injury or prejudice of another”.

Section 17(2) of ICA : the active concealment of a fact by one having knowledge or belief of the fact;

Misrepresentation : Section 18 of ICA is related to misrepresentation. In short, misrepresentation is a statement or conduct which conveys a false or wrong information without the intention to deceive.

Guarantee obtained by misrepresentation, invalid (Section 142)

Any guarantee which has been obtained by means of misrepresentation made by the creditor, or with his knowledge and assent, concerning a material part of the transaction, is invalid.

Guarantee obtained by concealment, invalid (Section 143)

Any guarantee which the creditor has obtained by means of keeping silence as to material circumstances, is invalid.

Illustrations

(a) A engages B as clerk to collect money for him. B fails to account for some of his receipts and A in consequence call upon him to furnish security for his duly accounting. C gives his guarantee for B’s duly accounting. A does not acquaint C with B’s previous conduct. B afterwards makes default. The guarantee is invalid.

(b) A guarantees to C payment for iron to be supplied by him to B to the amount of 2,000 tons. B and C have privately agreed that B should pay five rupees per tone beyond the market price, such excess to be applied in liquidation of an old debt. This agreement is concealed from A. A is not liable as a surety.

Guarantee on contract that creditor shall not act on it until co-surety joins (Section 144)

Condition precedent to liability : Where there is a condition precedent to the surety’s liability, he will not be liable unless that condition is first fulfilled. A partial recognition of this principle is to be found in section 144. Where a person gives a guarantee upon a contract that the creditor shall not act upon it until another person has joined in it as co-surety, the guarantee is not valid if that other person does not join.

Implied promise to indemnify surety (Section 145)

In every contract of guarantee there is an implied promise by the principal debtor to indemnify the surety, and the surety is entitled to recover from the principal debtor whatever sum he has rightfully paid under the guarantee, but no sums which he has paid wrongfully.

Illustrations

(a) B is indebted to C, and A is surety for the debt. C demands payment from A, and on his refusal sues him for the amount. A defends the suit, having reasonable grounds for doing so, but he is compelled to pay the amount of the debt with costs. He can recover from B the amount paid by him for costs, as well as the principal debt.

(b) C lends B a sum of money, and A, at the request of B, accepts a bill of exchange drawn by B upon A to secure the amount. C, the holder of the bill, demands payment of it from A, and on A’s refusal to pay, sues him upon the bill. A, not having reasonable grounds for so doing, defends the suit, and has to pay the amount of the bill and costs. He can recover from B the amount of the bill, but not the sum paid for costs, as there was no real ground for defending the action.

(c) A guarantees to C, to the extent of 2,000 rupees, payment for rice to be supplied by C to B. C supplies to B rice to a less amount than 2,000 rupees, but obtains from A payment of the sum of 2,000 rupees in respect of the rice supplied. A cannot recover from B more than the price of the rice actually supplied.

Co-sureties liable to contribute equally (Section 146)

Reference section no 42 : Devolution of joint liabilities :

When two or more person have made a joint promise, then, unless a contrary intention appears by the contract, all such persons, during their joint lives, and, after the death of any of them, his representative jointly with the survivor or survivors, and, after the death of the last survivor the representatives of all jointly, must fulfill the promise.

146. Co-sureties liable to contribute equally :

Where two or more persons are co-sureties for the same debt or duty, either jointly or severally, and whether under the same or different contracts, and whether with or without the knowledge of each other, the co-sureties, in the absence of any contract to the contrary, are liable, as between themselves, to pay each an equal share of the whole debt, or of that part of it which remains unpaid by the principal debtor.

Illustrations

(a) A, B and C are sureties to D for the sum of 3,000 rupees lent to E. E makes default in payment. A, B and C are liable, as between themselves, to pay 1,000 rupees each.

(b) A, B and C are sureties to D for the sum of 1,000 rupees lent to E, and there is a contract between A, B and C that A is to be responsible to the extent of one-quarter, B to the extent of one-quarter, and C to the extent of one-half. E makes default in payment. As between the sureties, A is liable to pay 250 rupees, B 250 rupees and C 500 rupees.

Liability of co-sureties bound in different sums (Section 147)

Co-sureties who are bound in different sums are liable to pay equally as far as the limits of their respective obligations permit.

Illustrations

(a) A, B and C, as sureties for D, enter into three several bonds each in a different penalties namely, A in the penalty of 10,000 rupees, B in that of 20,000 rupees, C in that of 40,000 rupees, conditioned for D’s duly accounting to E.D makes default to the extent of 30,000 rupees. A, B and C are each liable to pay 10,000 rupees.

(b) A, B and C, as sureties for D, enter into three several bonds each in different penalty namely, A in the penalty of 10,000 rupees, B in that of 20,000 rupees, C in that of 40,000 rupees, conditioned for D’s duly accounting to E. D makes default to the extent of 40,000 rupees. A is liable to pay 10,000 rupees, and B and C 15,000 rupees each.

(c) A, B, A and C, as sureties for D, enter into three several bonds, each in a different penalty, namely, A in the penalty of 10,000 rupees, B in that of 20, 000 rupees, C in that of 40, 000 rupees, conditioned of D’s duly accounting to E. D makes default to the exeunt 70,000 rupees. A,B and C have to pay each the full penalty of his bond.

Summary of above 3 illustration :

Liability of A=10,000 Liability of B=20,000 Liability of C=40,000

Illustration a : Default : 30,000/- ; A, B, & C will pay equally 10,000

b : Default : 40,000/- ; A will pay 10,000/- B & C will pay 15,000/-

c : Default : 70,000/- ; A will pay 10,000/- B, 20,000/- & C, 40,000/-