Dissolution of a Firm – The Indian Partnership Act, 1932 Law Notes – Law Tribune

Introduction

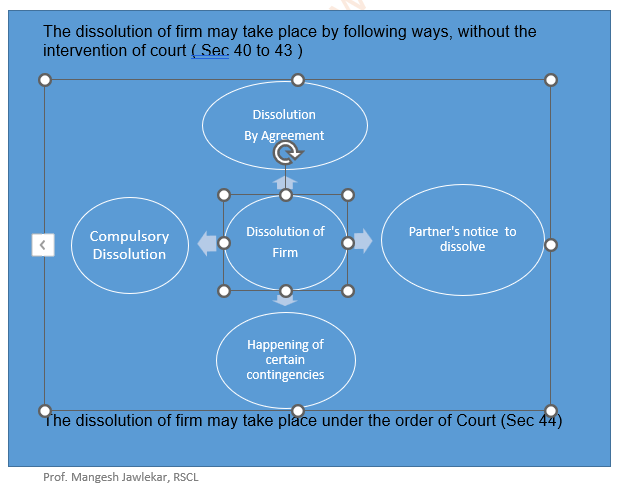

There are times in business where the firm needs to be dissolved for various reasons, the process has to be legally defined. This post explains legal provisions and procedure under Indian Partnership Act 1932 for dissolution of Partnership firm

Section 39 : Dissolution of a firm

The dissolution of partnership between all the partners of a firm is called as the “dissolution of the firm.”

The Act recognises the difference between a dissolution of the firm and retirement of a partner.

On dissolution each partner is paid his share of the profits, if any, whereas on the retirement, death or adjudication of one partner, a dissolution does not necessarily follow.

The Supreme court in the case, C.I.T., W.B. v. A. W. Figgis & Co., has clarified that, “there is no dissolution of the firm by the mere incoming or outgoing of partners. A partner can retire…and a person can be introduced in partnership by consent of the other partners. The reconstituted firm can carry on its business in the same firm’s name till dissolution.”

Section 40 : Dissolution by agreement

A firm may be dissolved with the consent of all the partners or in accordance with a contract between the partners.

Two ways to dissolve by agreement viz. consent & as per contract.

A partner’s refusal to advance money for partnership purpose is not evidence of a dissolution by consent or of an abandonment of his interest in the partnership as there may be some genuine reasons to do.

Section 41. Compulsory dissolution : A firm is dissolved-

- by the adjudication of all the partners or of all the partners but one as insolvent, or

- by the happening of any event which makes it unlawful for the business of the firm to be carried on or for the partners to carry it on in partnership:

PROVIDED that, where more than one separate adventure or undertaking is carried on by the firm the illegality of one or more shall not of itself cause the dissolution of the firm in respect of its lawful adventures and undertakings.

Sub-section a is based upon the obvious principle that there must be at least two persons to constitute a firm.

Proviso : Trading with a particular, for example, may very well be interrupted and forbidden by war, while trade with other countries is lawful within the scope of the partnership.

Section 42. Dissolution on the happening of certain contingencies

Subject to contract between the partners a firm is dissolved-

- if constituted for a fixed term, by the expiry of that term;

- if constituted to carry out one or more adventures or undertakings, by the completion thereof;

- by the death of a partner; and

- by the adjudication of a partner as an insolvent.

While section 41 is mandatory, section 42 is subject to contract.

Partnership for fixed term : Sayyed Absul v. Tumuluri :

Even there is a partnership for fixed period, the death of a partner taking place during the continuance of the partnership period, dissolves the partnership earlier. (Under section 47 the authority of partner, however continues for the purposes of winding up.

Completion of adventure : Sayyed Absul v. Tumuluri : The death of a partner dissolves earlier even a partnership for a particular adventure.

Bansi Lal Jalan v. Chiranjitlal Sarawii : Completion of adventure or undertaking does not mean supply of part or even substantial part of the agreed goods. It is completed upon the realisation of amount in respect of the said property. It is completed upon the realisation of mount in respect of the said property.

Death of partner : It is often desirable, and in practice it is not uncommon to provide by agreement that the death of a partner shall not dissolve the contract as between other. Bachubhai v. Shamji : Partners may agree that on the death of any of them his nominee or legal representative shall be entitled to take his place.

Insolvency of a partner : Under the Indian Contract Act (old) as per section 254(2) the adjudiacation of a partner did not operate as a dissolution. It was merely one ground on which dissolution could be sought by the other partners.

Under the present section, the insolvency of partners operates as a dissolution of the firm, unless there is a contract to the contrary.

As per section 34(1), the date of dissolution would be the date on which the order of adjudication is made.

Section 43. Dissolution by notice of partnership at will

- Where the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm.

- The firm is dissolved as from the date mentioned in the notice as the date of dissolution or, if no date is so mentioned, as from the date of the communication of the notice.

Parsons v. Hayward : No particular formality is required, but the notice must be an unambiguous intimation of a final intention to dissolve a partnership. Dhulia-Amalner Municipal Transport v. Raychand : The notice must be explicit (definite) precise and final. Jones v. Lloyd : The notice should be served on all the other partners. The notice once given, cannot be withdrawn unless all other partners consent.

Manibhai Patel v. Swashray construction : In a partnership at will it is open to a partner even if there is no dispute between them to dissolve the firm by virtue of section 43 of the Act.

Date of dissolution : The dissolution takes effect from the date mentioned in the notice, or if no date is mentioned, as from the date of communication of the notice. (C.I.T. v. Pigot Champan & Co.)

Section 44. Dissolution by the court

At the suit of a partner, the court may dissolve a firm on any of the following grounds, namely-

- that a partner has become of unsound mind, in which case the suit may be brought as well by the next friend of the partner who has become of unsound mind as by any other partner;

- that a partner, other than the partner suing, has become in any way permanently incapable of performing his duties as partner;

- that a partner, other than the partner suing, is guilty of conduct which is likely to affect prejudicially the carrying on of the business, regard being had to the nature of the business;

- that a partner, other than the partner suing, wilfully or persistently commits breach of agreements relating to the management of the affairs of the firm or the conduct of its business, or otherwise so conducts himself in matters relating to the business that it is not reasonably practicable for the other partners to carry on the business in partnership with him;

- that a partner, other than the partner suing, has in any way transferred the whole of his interest in the firm to a third party, or has allowed his share to be charged under the provisions of rule 49 of Order XXI of the First Schedule to the Code of Civil Procedure, 1908 (5 of 1908) or has allowed it to be sold in the recovery of arrears of land revenue or of any dues recoverable as arrears of land revenue due by the partner;

- that the business of the firm cannot be carried on save at a loss; or on any other ground which renders it just and equitable that the firm should be dissolved.

- On any other ground which renders it just and equitable that the firm should be dissolved.

(a) Insanity : Insanity does not dissolve the partnership (by the fact or act itself) but confirmed lunacy provides a ground for dissolution by the court if other partners apply to court for dissolution (Jugal Chandra v. Gunny Hajee Ahmed).

It is now made clear that, in the case of insanity, a next friend on behalf of the lunatic may sue for dissolution. The judge exercising jurisdiction in lunacy is also empowered to dissolve a partnership in the case of partner becoming a lunatic (section 52 of Indian Lunacy Act, 1912).

(b) Incapacity : Incapacity may be due to based on medical grounds like paralysis etc. Where a partner is imprisoned for a long period of time, the Court may dissolve the partnership.

(c) Misconduct : The sub-section c does not require that the misconduct must be in the actually carrying on the business of the firm. It is enough if the misconduct is likely to affect prejudicially the business of the firm.

Breaches of agreement.

(d) Breaches of agreements :- Persistent refusal or neglect to attend the business would give to any partner right to apply for dissolution. (Krishnamachariar v. Sankara Sah).

Neglect to account and taking away of partnership books are other instances. Breaches of partnership agreement must be substantial.

(e) Where two out of three partners assigned their shares, it was held that the case fell under this clause. (Domaty v. Ramen Chetty)

(f) Business carried on at a loss : If the trial judge orders a dissolution neither capriciously nor without disregard of legal principles, the exercise of the discretion is not open to review upon appeal. (Rehmat-un-Nissa Begam v. Price).

(g) Any other grounds : All matters which would not strictly fall under the sub-sections, would fall under this sub-section (Hasham v. Nariman).

Section 45. Liability for acts of partners done after dissolution

- Notwithstanding the dissolution of a firm, the partners continue to be liable as such to third parties for any act done by any of them which would have been an act of the firm if done before the dissolution, until public notice is given of the dissolution:

PROVIDED that the estate of a partner who dies, or who is adjudicated an insolvent, or of a partner who, not having been known to the person dealing with the firm to be a partner, retires from the firm, is not liable under this section for acts done after the date on which he ceases to be a partner.

- Notices under sub-section (1) may be given by any partner.

This section provides that, despite dissolution, the partners cannot escape their liability to third parties for acts done even thereafter unless public notice of dissolution is given. This provision accord with similar provision made under section 32(3) in respect of retiring partner and under section 33(2) in respect of an expelled partner.

These provisions emphasize the necessity of giving a public notice before a partner could terminate his further liability whether it is a case of dissolution, retirement or expulsion.

Illustration :

A and B trade together in partnership.

They execute a deed declaring that the partnership is dissolved as from the day of 1st Jan.

They do not give public notice of the dissolution, but continue business.

In February, A endorses a bill in the partnership name to C, who is not aware of the dissolution.

The firm is liable on the bill.

Section 46. Rights of partners to have business wound up after dissolution

On the dissolution of a firm every partner or his representative is entitled, as against all the other partners or their representatives, to have the property of the firm applied in payment of the debts and liabilities of the firm, and to have the surplus distributed among the partners or their representatives according to their rights.

The provisions of sections 46, 48, 49, 50,51, and 55 should be borne in mind for the purpose of taking accounts of the assets, liabilities, profit, loss, payment of debts, appropriation of assets, sale of stock and goodwill etc. upon dissolution of the partnership.

This section deals with one of the rights of the partners of a dissolved partnership.

The right of a partner as against other partners to enforce payment of partnership debts out of partnership property is in the nature of an equitable lien, which has nothing to do with possession and is to be distinguished from possessory lien.

A partner’s or his representative’s lien with reference to partnership assets is on the surplus of the assets of the firm and not on any particular item of property belonging to partnership.

Distribution of the balance in proportion to their rights as provided for in the partnership deed or in proportion to their respective interests.

Kassa Mal v. Gopi : No suit will lie as a general rule by one partner against another for partnership accounts without praying for a dissolution.

Section 47. Continuing authority of partners for purposes of winding up

After the dissolution of a firm the authority of each partner to bind the firm, and the other mutual rights and obligations of the partners continue notwithstanding the dissolution, so far as may be necessary to wind up the affair of the firm and to complete transactions begun but unfinished at the time of the dissolution, but not otherwise:

PROVIDED that the firm is in no case bound by the acts of a partner who has been adjudicated insolvent; but this proviso does not affect the liability of any person who has after the adjudication represented himself or knowingly permitted himself to be represented as a partner of the insolvent.

The power of each partner however, extends only so far it is necessary to wind up the affairs of the firm and to complete the transaction already begun.

Babu v. Gokuldas : Even after dissolution, a partner can give a valid security on the property of partnership for money required to complete a contract made by a firm prior to the dissolution.

Section 48. Mode of settlement of accounts between partners

In settling the accounts of a firm after dissolution, the following rules shall, subject to agreement by the partners, be observed-

- losses, including deficiencies of capital, shall be paid first out of profits, next out of capital, and, lastly, if necessary, by the partners individually in the proportions in which they were entitled to share profits;

- the assets of the firm, including any sums contributed by the partners to make up deficiencies of capital, shall be applied in the following manner and order-

- in paying the debts of the firm to third parties;

- in paying to each partner rateably what is due to him from the firm for advances as distinguished from capital;

- in paying to each partner rateably what is due to him on account of capital; and

- the residue, if any, shall be divided among the partners in the proportions in which they were entitled to share profits.

The rules laid down in this section are to observed provided there is no different stipulation in the partnership deed. (Nawaneetdas v. Gordhandas). Any such stipulation must be clearly proved before the provisions of clauses (a) and (b) are disregarded.

Where a partnership is dissolved, and after the debts to third parties have been paid and advances made by a partner have been repaid, the assets are insufficient to repay each partner his capital in full, any deficiency must be borne by the partners in the same proportion as the profits would have been divided.

Muhammad Ussain v. Abdul Gaffoor : The assets are to be valued on the basis of their fair value to the firm i.e. at the market value on the date of dissolution and not on the basis of their book value.

Section 49. Payment of firm debts and of separate debts

Where there are joint debts due from the firm, and also separate debts due from any partner, the property of the firm shall be applied in the first instance in payment of the debts of the firm, and, if there is any surplus, then the share of each partner shall be applied in payment of his separate debts or paid to him.

The separate property of any partner shall be applied first in the payment of his separate debts, and the surplus (if any) in the payment of the debts of the firm.

50. Personal profits earned after dissolution

Subject to contract between the partners, the provisions of clause (a) of section 16 shall apply to transactions by any surviving partner or by the representatives of a deceased partner, undertaken after the firm is dissolved on account of the death of a partner and before its affairs have been completely wound up:

PROVIDED that where any partner or his representative has bought the goodwill of the firm, nothing in this section shall affect his right to use the firm name.

( Section 16 (a) : If a partner derives any profit for himself from any transaction of the firm, or from the use of the property or business connection of the firm or the firm name, he shall account for that profit and pay it to the firm; )

Haji Hedayetullah v. Mahomed Kamil : Where a partner, after dissolution and before the affairs of the partnership are wound up, derives any profit for himself from any transaction of the firm, or from the use of the property or business connection of the firm or the firm name, he shall account for that profit and pay to the surviving partner or the representative of the deceased partner.

Dissolution of firm does not put an end to rights accrued during existence of partnership. The rights and liabilities of the partners in respect of the partnership property would be discharged only when the firm is finally wound up and the properties of the firm are distributed. Section 50 & 53 indicate to the said effect.

The partner of a dissolved firm can not only exercise his right under section 50, he may also restrain the use of the firm’s name and firm’s property in terms of section 53.

Section 51. Return of premium on premature dissolution

Where a partner has paid a premium on entering into partnership of a fixed term, and the firm is dissolved before the expiration of that term otherwise than by the death of a partner, he shall be entitled to repayment of the premium or of such part thereof as may be reasonable, regard being had to the terms upon which he became a partner and to the length of time during which he was a partner, unless-

- the dissolution is mainly due to his own misconduct, or

- the dissolution is in pursuance of an agreement containing no provision for the return of the premium or any part of it.

Conditions necessary to attract applicability of section 51.

- The partnership must be for a fixed term

- The firm must have been dissolved prematurely

- Must have been dissolved otherwise than by the death of a partner.

And section 51 will not operate when :

- The firm is dissolved, though prematurely, but on account of the death of a partner. Or

- The dissolution is mainly due to the misconduct of the partner who had paid the premium.

- The dissolution is in pursuance of an agreement which contains no provision for the return of the premium, or any part thereof.

Where, therefore, the partnership is dissolved :-

- Without the fault of either party, or

- Owing to the fault of both, or

- Owing to the fault of the partner receiving the premium, or

- Owing to the insolvency of the partner receiving the premium, where the partner paying the premium was not aware of the other’s embarrassed circumstances at the time of entering into partnership.

The partner paying the premium is entitled to the proportionate part of the premium.

Illustration :

A and B become partners for ten years, A paying B a premium of Rs.1000/=. A quarrel occurs at the end of the eight years, both parties being in the wrong, and s dissolution is decreed. A is entitled to a return of rs. 200 of the premium from B.

Lee v. Page : If by mutual agreement the partnership is dissolved before the expiry of the term fixed, and nothing is provided at the time of the dissolution for the return of the premium, the partner, who paid the premium cannot afterwards claim to have any part of it returned.

The section applies only to partnerships for a fixed term and not to a partnership at will.

Section 52 Rights where partnership contract is rescinded for fraud or misrepresentation

Where a contract creating partnership is rescinded on the ground of the fraud or misrepresentation of any of the parties thereto the party entitled to rescind is, without prejudice to any other right, entitled-

- to a lien on, or a right of retention of, the surplus or the assets of the firm remaining after the debts of the firm have been paid, for any sum paid by him for the purchase of a share in the firm and for any capital contributed by him;

- to rank as a creditor of the firm in respect of any payment made by him towards the debts of the firm; and

- to be indemnified by the partner or partners guilty of the fraud or misrepresentation against all the debts of the firm.

Illustration :-

–‘A’ fraudulently induces ‘B’ to enter into partnership with him.

–‘B’ pays ‘A’ a premium of Rs. 5000.

–Within few months, the firm incurs liabilities to the extent of Rs. 10000

and on discovering the fraud, ‘B’ files a suit for the rescission of the

contract creating partnership, and the contract is rescinded.

–In the meanwhile creditors of the firm levy attachment on ‘B’ who pays

Rs. 3000 to the creditors.

–‘B’ on rescinding the contract is entitled to a decree for Rs. 5000 and

Rs. 3000 against ‘A’ and is entitled to a lien for the said amounts on

the assets of the firm.

–He is also entitled to a declaration that ‘A’ is bound to indemnify ‘B’

against all outstanding debts, claims, demands, and liabilities which ‘B’

has become or may become liable to pay.

( Based on Newbigging v. Adam ).

The rights conferred by clause (a) (b) & (c) are in addition to the other rights of such a partner. The other rights would be, refund of capital, premium, contribution, damages, interest on all payments made, costs in the suit for recession.

This section lays down the rights of a partner on his rescinding the contract, but these rights he is entitled to only against the partner. But as against third parties, it is no defence that he was fraudulently induced to become a partner. Such a contract is voidable, and until the contract is rescinded, all the partners are liable to creditors.

Section 53. Right to restrain from use of firm name or firm property

After a firm is dissolved, every partner or his representative may, in the absence of a contract between the partners to the contrary, restrain any other partner or his representative from carrying on a similar business in the firm name or from using any of the property of the firm for his own benefit, until the affairs of the firm have been completely wound up:

PROVIDED that where any partner or his representative has bought the goodwill of the firm, nothing in this section shall affect his right to use the firm name.

A surviving partner, while he has authority to act for the best interest of the business, is bound not to act in such a manner as to destroy any part of its value. Goodwill is an asset of the firm (saleable..sec 55). Certainly, one partner may be restrained from using the firm name or the firms property to do business for his own exclusive profit pending liquidation.

Section 54. Agreements in restraint of trade

Partners may, upon or in anticipation of the dissolution of the firm, make an agreement that some or all of them will not carry on a business similar to that of the firm within a specified period or within specified local limits; and notwithstanding anything contained in section 27 of the Indian Contract Act, 1872 (9 of 1872), such agreement shall be valid if the restrictions imposed are reasonable.

Deva Shanna v. Laxminarain : a firm consisting of two partners was the selling agent of a mill. It is agreed that on the termination of the partnership neither partner is to take up the agency of the mill. Such a clause is in restraint of trade and the restrictions unenforceable.

Whether the restrictions are reasonable will depend on the facts of each case.

Restrictions may be with respect to time and place.

Section 55. Sale of goodwill after dissolution

- In settling the accounts of a firm after dissolution, the goodwill shall, subject to contract between the partners, be included in the assets, and it may be sold either separately or along with other property of the firm.

- Rights of buyer and seller of goodwill :- Where the goodwill of a firm is sold after dissolution, a partner may carry on a business competing with that of the buyer and he may advertise such business, but, subject to agreement between him and the buyer, he may not-

- use the firm name,

- represent himself as carrying on the business of the firm, or

- solicit the custom of persons who were dealing with the firm before its dissolution.

- Agreement in restraint of trade :- Any partner may, upon the sale of the goodwill of a firm, make an agreement with the buyer that such partner will not carry on any business similar to that of the firm within a specified period or within specified local limits and, notwithstanding anything contained in section 27 of the Indian Contract Act, 1872 (9 of 1872), such agreement shall be valid if the restrictions imposed are reasonable.