Company Meaning & Evaluation of Companies Act, 2013 – Law Notes

What is the meaning of ‘Company’ ?

Oxford Dictionary :

— being with another or others

–people assembled

–people working together or united for business purpose.

Company is an association of persons formed for the purpose to achieve some common objects.

Section 3 (1) (i) of The Companies Act, 1956 :- ” company” means a company formed and registered under this Act or an existing company.

The Companies Act, 2013 : Section 2(20) : ―’Company’ means a company incorporated (समाविष्ट) under this Act or under any previous company law;

From Latin words :

The term ‘Company’ is derived from the Latin word

“com” meaning “with” or “together”; “panis” that is “bread”. Together means Company is an association of person who takes their meals together.

Thus, in popular parlance, a company denotes an association of likeminded persons formed for the purpose of carrying on some business or undertaking.

A Company is a corporate (सामुदायिक / संयुक्त) body and a legal person having status and personality distinct and separate from the members constituting it.

Since a corporate body i.e. a company is the creation of law, it is not a human being, it is an artificial juridical person, i.e. created by law. It is clothed with many rights, obligations, powers and duties prescribed by law. It is called a ‘person’. Being the creation of law, it possesses only the powers conferred upon it by its Memorandum of Association which is charter of the Company. Within the limits of powers conferred by the charter it can do all acts as a natural person may do.

Evolution of Companies Act, 2013

Introduction : Our Companies Acts have been modelled on the English Acts. The first Companies Act was passed in India in 1850. It provided for the registration of the companies and transferability of shares.

The Companies Act, 1956 was enacted with the object to amend and consolidate the law relating to companies. This Act provided the legal framework for corporate entities in India. The Companies Act, 1956 had undergone changes by several amendments. Major amendments were made through the Companies (Amendment) Act, 1988, and then again in 1998, 2000 and in 2002 through the Companies (Second Amendment) Act, 2002…….Finally, An Act to consolidate and amend the law relating to companies, “The Companies Act, 2013” was enacted, and subsequently, some more amendments were made through The Companies (Amendment) Act, 2015.

The Act consists of 470 sections with VII shedules.

(With section 2 providing 95 definitions)

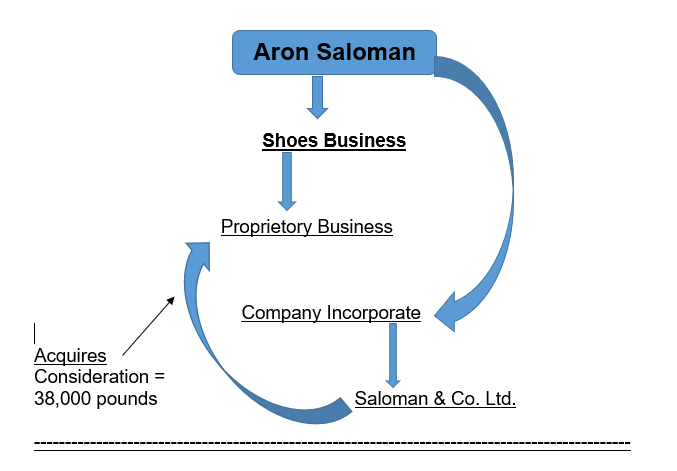

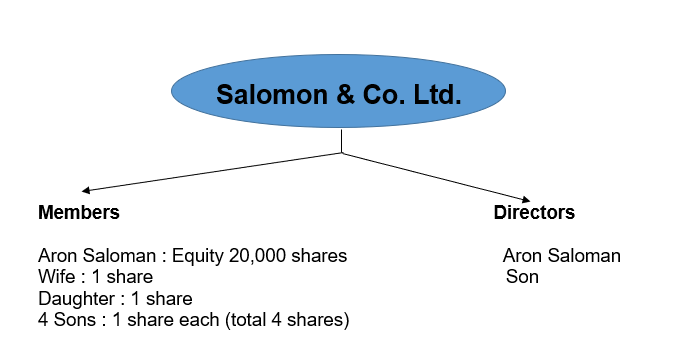

Saloman v. Saloman & Co.

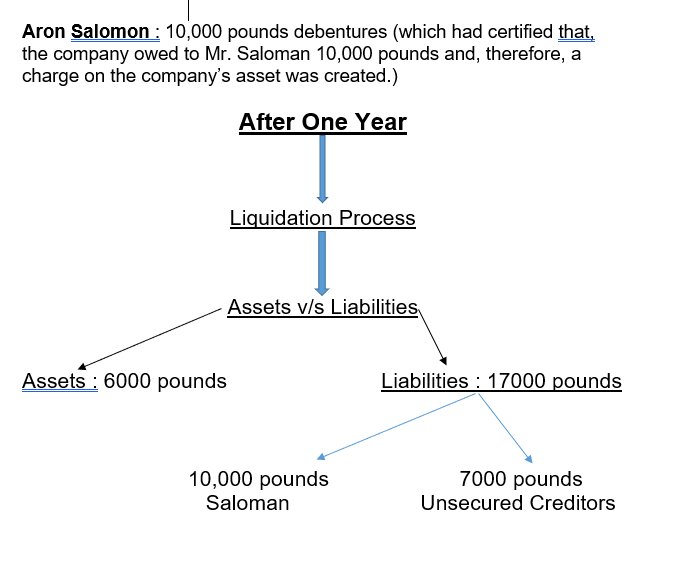

Creditors :

Question is…. who should be paid first ?

In this case, it was held that, once a company was incorporated, it became a separate person in the eyes of law. Such company being a separate person, was independent from Mr. Saloman.

Even though, Mr. Saloman was virtually the holder of all the shares of the company, he was a creditor secured by its debentures and, therefore, Mr. Saloman was entitled to repayment in priority to the unsecured creditors of the Saloman & Co. Ltd.

Because, this company had acquired a separate legal existence or a separate legal entity.

It was observed that, the Saloman & Co. Ltd was a duly registered company which was the real company with the compliance of all relevant legal requirements.

Therefore, it should be regarded as distinct and independent from it’s shareholders.

CATHERINE LEE V LEE’S AIR FARMING LIMITED (1960)

In 1954 the appellant’s husband Lee formed the company named LEE’S AIR FARMING LTD. for the purpose of carrying on the business of aerial top-dressing with 3000 thousand share of 1euro each forming share capital of the company and out of which 2999 shares were owned by Lee himself.

He voted himself the managing director and got himself appointed by articles as chief pilot at a salary.

He exercised unrestricted power to control the affairs of the company and made all the decision relating to contracts of the company.

Company entered into various contract with insurance agencies for insurance of its employees and few premiums of the policies were paid through companies bank account for the personal policies taken by Lee in its own name.

Lee apart from being the director of the company was also a pilot. In March, 1956, Lee was killed while piloting the aircraft during the course of aerial top-dressing. Lee’s wife who is appellant claimed worker compensation under New Zealand Workers’ Compensation Act, 1922 as she claimed that Lee died during work as employee of the company. The New Zealand Court of Appeal declined the claim of appellant as it refused to hold that Lee was a worker, holding that a man could not in effect, employ himself.

Respondent company claimed that Lee was owner of the company and had maximum number of shares in the company so his wife is not entitled for workmen compensation as he was not the employee of the company. Respondent claimed that Mr. Lee couldn’t be the owner of the company as there is no master-servant relation that exist between him and the company.

“It was held that, Lee was a separate person from the company he formed and his widow was held entitled to get compensation. In effect the magic of corporate personality enabled him (Lee) to be the master and servant at the same time and enjoy the advantages of both.