Shares, Stocks, Types of Shares, Share Capital and Types of Share Capital – Law Notes

No company can possibly function without having its own capital. The memorandum of the company has to state the amount of capital with which the company is proposed to be registered. Thus the capital generally means a particular amount of money with which a business is started.

Share

A share is the interest of a member in a company. Section 2(84) of the Companies Act, 2013 states, “share” means a share in the share capital of a company and includes stock.

A share is a single unit of stock. It represents the interest of a shareholder in the company, measured for the purposes of liability and dividend. It attaches various rights and liabilities.

Black’s law dictionary defines a share as ‘the unit into which the proprietary interests in a corporation are divided.

Shares are also regarded as movable property by section 2 of ‘The Sale of Goods Act’. Shares can therefore can be regarded as ‘goods’.

Shares can be categorized into two types :-

1. Equity Shares :

These are also known as ordinary shares and comprise the bulk of the shares being issued by a particular company. Equity shares are transferable and are traded actively by investors in stock markets. Equity shareholders, are entitled to voting rights on company issues and also have the right to receive dividends.

2. Preference Shares :

Preferential shareholders receive preference in receiving profits of a company as compared to ordinary shareholders. Also, in the event of liquidation of a particular company, the preferential shareholders are paid off before ordinary shareholders.

Distinction between Equity Shares & Preference Shares.

Basis of Difference | Equity Shares | Preference Shares |

Definition | Equity shares represent the ownership of a company. | Preference shareholders have a preferential right or claim over the company’s profits and assets. |

Dividend Pay-out | Equity shareholders receive dividends only after the preference shareholders receive their dividends. | Preference shareholders have the priority to receive dividends. |

Dividend Rate | Varies based on the earnings. | The rate is fixed. |

Bonus Shares | Equity shareholders are eligible to receive bonus shares against their existing holdings. | Preference shareholders do not receive any bonus shares against their holdings. |

Capital Repayment | Equity shareholders are paid last. | Preference shareholders are paid before the equity shareholder when the company is winding up. |

Voting Rights | Equity shareholders enjoy voting rights. | Preference shareholders do not enjoy voting rights. |

Participation in Management Decisions | Equity shareholders have voting rights, and as a result, they participate in the management decisions. | Preference shareholders do not participate in management operations. |

Redemption | Equity shares cannot be redeemed. | Preference shares can be redeemed. |

Convertibility | Equity shares cannot be converted. | Preference shares can be converted to equity shares. |

Types | Ordinary shares, Bonus shares, Rights shares, Sweat equity, and Employee stock options. | Convertible, Non-Convertible, Redeemable, Irredeemable, Participating, Non-Participating, Cumulative, Non-Cumulative, Preference Share with a Callable Option, and Adjustable Preference Shares |

Company’s Obligation | The company has no obligation to pay dividends to equity shareholders. | The company is obligated to pay dividends to preferred shareholders. |

Liquidity | Highly liquid, traded on the stock market. | Not liquid, but the company can buy back the shares. |

Liquidation | Equity shareholders are paid only after making payments to creditors and preference shareholders. | Preference shareholders are paid after paying the creditors and before the equity shareholders. |

Rights & Liabilities of Share holders

Common shareholders are granted six rights mainly : Voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Also, they have right to receive notice of general meeting/to appoint proxy & to apply Tribunal for winding up the company.

The main liability of shareholder is to pay the unpaid amount of the face

Value of the shares held by them.

Allotment of Shares

Offer for shares are made on application forms supplied by the company. When an application is accepted, it is an allotment. It is the acceptance by the company of the offer to take shares.

A valid allotment has to comply with the requirements of the Act and general principles of the law of contract relating to acceptance of offers.

A) Statutory restrictions on allotment :

i) Minimum Subscription and Application Money (Sec 39) : When shares are offered to the public, the amount of minimum subscription has to be stated in the prospectus and no allotment can be made by company unless the sum payable on application has been paid to and received by the company.

ii) Permission of the stock exchange (Sec 40) : Every company which makes a public offer must, before making such an offer apply to one or more recognised stock exchange or exchanges and obtain permission. Any default, the company is punishable with fine. In addition every officer in default is also punishable with imprisonment or fine.

B) The general principles of law of contract :

i) Allotment by proper authority : An acceptance is valid only if made by the proper authority.(board of directors). Any allotment made by any other authority is an invalid allotment unless it is delegated by the board of directors under powers given by the article of company.

ii) Allotment to be made within reasonable time : It is settled as per the law of contracts that, communication of offer must be communicated within reasonable time. So allotment of shares must also be made within reasonable time.

iii) Communication of allotment : It is necessary to communicate the allotment of shares. A person cannot be treated as shareholder unless notice of allotment has been sent to him.

iv) Conditional allotment not allowed : It is a well settled principal of law of contract that, a valid acceptance must be absolute and unconditional. So is the case with the allotment. Allotment must be in accordance with the terms and conditions of the application.

Share Certificate and Share Warrant :

A share certificate is an instrument issued under the common seal of the company and which specify the number of shares held by a member and is a prima facie evidence of the title of such a member to those shares.

Section 56 of the Act lays down specific time limits within which share certificates are to be delivered—whether at the time of allotment or transfer or transmission.

If there is any default in complying with the above time-limits, the company becomes punishable with a fine ranging between Rs. 25,000 and Rs 5 Lakhs.

A share warrant (is a financial instrument that gives the holder the right, but not the obligation, to purchase a specified number of shares of stock at a specified price within a specified time period. They are similar to stock options but are typically issued by the company itself, rather than being traded on an exchange. Share warrants can be used as a form of financing for the issuing company, and can also be used as a form of investment for the holder. “The Companies Act, 2013 does not provide for issue of share warrants by a company.”

Key Differences between Share Certificate and Share Warrant :

- Share certificates represent ownership in a company, while share warrants are a form of options contract that give the holder the right, but not the obligation, to purchase shares at a specific price and time.

- Share certificates are generally issued to shareholders as evidence of ownership, while share warrants are issued to investors as a separate security.

- Share certificates have no expiration date, while share warrants have a fixed expiration date.

- Share certificates are transferable, while share warrants can be exercised or sold.

- Share certificates certifies the shareholder’s membership in the company. Share warrants certifies the right to acquire shares.

- Share cetificates are issued by Public as well as Private company. Share Warrants are issued by Public company only.

- A Share certificate can be issued to partly paid up shares. AShare Warrant is issued only with regard to fully paid up shares.

Stocks : A stock represents a part ownership of a company, including a claim on the company’s earnings and assets. Stock is the aggregate of fully-paid shares. When you buy a company’s stock, you’re purchasing a small piece of that company, called a share. Stocks represent ownership in a publicly traded company. When you buy a company’s stock, you become part-owner of that company. For example, if a company has 100,000 shares, and you buy 1,000 of them, you own 1% of the company.

Difference between Stock and Share :

Meaning : Stock is an aggregate of fully paid up shares whereas a share is a share in the share capital of a company.

Stocks give you an ownership interest in one or more companies. On the other hand, shares represent ownership of one specific company only. For instance, if A has made an investment in stocks, it may mean that A has a portfolio of shares that spans different companies. However, if A has made an investment in shares, you may ask A, which company’s shares have been invested in, or how many shares they have invested in.

Paid Up : Stocks are, by definition, always fully paid up, while shares are paid up in full or in part.

Original Issue : A company cannot directly issue stock. It must first issue shares and then convert the shares into stock.

Division in parts : Stocks need not be divided into equal parts. Shares are divided in equal parts.

Definite number : Stocks need not be numbered. Shares have distinctive numbers

Value : The value of two different stocks can be different whereas the value of each share of a company will be the same.

As per the section 61(1)(c), A limited company having a share capital may, if so authorised by its articles, alter its memorandum in its general meeting to convert all or any of its fully paid-up shares into stock, and reconvert that stock into fully paid-up shares of any denomination.

Transfer And Transmission of Securities (Section 56)

The phrase ‘Transfer of Securities’ refers to the transfer of ownership in the securities by way of purchase, sale or gift, and ‘transfer’ refers to the act of simply

handing over or parting with something.‘Transmission of Securities’ means the passing of property or title in securities by operation of law from a member of his legal representative on the happening of a certain event like death, insolvency or lunacy or if the member being a company goes in liquidation.

The shares or debentures or other interest of any member in a Company shall be movable property transferable in the manner provided by the articles of the Company. [Section 44].

Compulsory Requirements for transfer of shares (Procedure):

1. Proper duly stamped, dated and executed in Form No. SH-4 by or on behalf of the transferor and the transferee and specifying the name, address and occupation, if any, of the transferee has been delivered to the company by the transferor or the transferee within a period of sixty days from the date of execution, along with the certificate relating to the securities, or if no such certificate is in existence, along with the letter of allotment of securities.

2. The instrument of transfer, that is, the share transfer form, must be duly stamped.

3. If the instrument of transfer has been lost or the instrument of transfer has not been delivered within 60 days of execution, the company may register the transfer on such terms as to indemnity as the Board may think fit. [Proviso to Section 56(1)].

4. If the board of directors approves the transfer, the name of the transferee is entered on the register of members of the company and the share certificate is returned to the transferee with his name endorsed thereon.

Transfer of Partly paid shares :

Where an application is made by the transferor alone and relates to partly paid shares, the transfer shall not be registered, unless the company gives the notice of the application, in such manner as may be prescribed, to the transferee and the transferee gives no objection to the transfer within two weeks from the receipt of notice.

Delivery of Certificates of all Securities : As per section 56(4), the company has to deliver the certificates of all securities whether allotted, transferred or transmitted :-

(a) within a period of two months from the date of incorporation, in the case of subscribers to the memorandum;

(b) within a period of two months from the date of allotment, in the case of any allotment of any of its shares;

(c) within a period of one month from the date of receipt by the company of the instrument of transfer under sub-section (1) or, as the case may be, of the intimation of transmission under sub-section (2), in the case of a transfer or transmission of securities;

(d) within a period of six months from the date of allotment in the case of any allotment of debenture:

Provided that where the securities are dealt with in a depository, the company shall intimate the details of allotment of securities to depository immediately on allotment of such securities.

Transfer by Legal Representative : As per section 56(5),Transfer of any security or other interest of a deceased person in a company, requested by any legal representative shall be valid as if such person had been the holder at the time of execution of such instrument of transfer.

Punitive provisions : Where any default is made in complying with the provisions of sub-sections (1) to (5), the company and every officer of the company who is in default shall be liable to a penalty of fine as prescribed. Apart from the liabilities under The Depositories Act, 1996, where any depository or depository participant, with an intention to defraud a person, has transferred shares, it shall be liable under section 447.

Transfer of shares of private company : Although sec 44 of the Act applies to all companies, a private company must have some restrictions on the transfer of its shares because, even though the private company are separate legal entity, for practicle purposes, they resembles the partnership. Accordingly, it is expected to have higher degree of control over transfer of shares.

If a private company limited by shares refuses, whether in pursuance of any power of the company under its articles or otherwise, to register the transfer of, or the transmission by operation of law of the right to, any securities or interest of a member in the company, it shall within a period of thirty days from the date on which the instrument of transfer, or the intimation of such transmission, as the case may be, was delivered to the company, send notice of the refusal to the transferor and the transferee or to the person giving intimation of such transmission, as the case may be, giving reasons for such refusal.

Transfer of shares of public company : Shares and other securities of a public company are freely transferable. If a public company without sufficient cause refuses to register the transfer of securities within a period of thirty days from the date on which the instrument of transfer or the intimation of transmission, as the case may be, is delivered to the company, the transferee may, within a period of sixty days of such refusal or where no intimation has been received from the company, within ninety days of the delivery of the instrument of transfer or intimation of transmission, appeal to the Tribunal.

Appeal to the Tribunal : If the public company refuses to register transfer or transmission of shares, the aggrieved person may approach the Tribunal for relief against such refusal. After hearing the parties, Tribunal may either dismiss the appeal or order transfer or transmission.

Rights as between Transferor and Transferee : Until the transfer is registered, the transferor remains the holder of shares so far as the company is concerned. During this period, the legal ownership of the shares remains in the transferor. The transferor is a constructive trustee. The transferor should not sell the shares again, nor do anything to prevent the company from accepting the transfer.

Transmission of Shares

**Transmission of shares is a process by operation of law whereunder the Shares are registered in a Company in the name of deceased person or an insolvent person are registered in the name of his legal heirs by the Company on proof of death or insolvency as the case may be.

**If the shareholder has signed the Nomination Form and lodged with the Company and the Company has taken it on records, then with a copy of the death certificate produced before the Company, the Company can transmit the shares to the nominee.

**Transmission of shares takes place when registered member dies or is adjudicated insolvent or lunatic by competent court.

**Article of the Company usually provide the provisions of Transmission of shares. In absence of such provisions, Company will follow Regulations 23 to 27 of Table F of the Companies Act, 2013 to govern the provision of Transmission of shares.

**Legal representatives are entitled to the shares held by the deceased person and company must accept the evidence of Succession.

Issue of Shares at Premium

The issue of shares at premium refers to the issue of shares at a price higher than the face value of the share. In other words, the premium is the amount over and above the face value of a share. Example if a company issues a share of nominal or face value of ₹100 at ₹110, it issues it at 10% premium.

There is no restriction whatever, on sale of shares at a premium but SEBI guidelines have to be observed.

A company may call the amount of premium from the applicants or shareholders at any stage, i.e. at the time of application, allotment or calls. However, a company generally calls the amount of Premium at the time of allotment.

The company must transfer the amount of Premium in a separate account i.e. Securities Premium A/c, as it is not a part of the Share Capital.

Section 52 of the Companies Act, 2013 states how a company can use the Securities Premium. The following are the provisions regarding this:

1. The company can use the amount towards the issue of un-issued shares to the shareholders or members of the company as fully paid bonus shares.

2. It can use this amount to write off the preliminary expenses.

3. The company may use it to pay the premium on the redemption of debentures or redeemable preference shares.

4. It can also use this amount to write off the expenses incurred, commission paid or discount allowed on the issue of any securities or debentures.

5. It can also use it for buy-back of own shares or any other securities.

Issue of Shares at Discount

The issue of shares at a discount means the issue of the shares at a lesser price than the face value of the share. For example, if a company issues share of Rs.10 at Rs.9, then Rs.1 is the amount of discount.

It is nothing but a loss to the company. One must remember that the issue of share below the Market Price (MP) but above the Face Value (FV) is not termed as ‘Issue of Share at Discount’.

Generally speaking, the Companies Act have always discouraged issue of shares for a price less than their face value. Allotment of shares at a discount is ultra vires. As per section 53, a company shall not issue shares at a discount. Any share issued by a company at a discount shall be void.

Where any company issue shares at discount, such company and every officer who is in default shall be liable to a penalty as prescribed in section 53

Sweat Equity Shares

Section 2(88) defines “sweat equity shares” means such equity shares as are issued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called;

Companies issue sweat equity shares to reward and incentivise their employees, directors, or other service providers for their contributions to the company. These sweat equity shares are at a discount or for free to those who have contributed their time, effort, or intellectual property to the company.

Forfeiture of Shares

A shareholder subscribing to the shares of a company, has to pay the subscription price of the shares to the company. The company may call upon the shareholder to pay the price in instalments. The instalment payments are called call money. The call money is due from the shareholders. Non-payment of the dues can result in forfeiture of the shares.

A company can forfeit shares only when the Articles of Association of the company contain a provision for share forfeiture.

On forfeiture, we need to cancel the shares and to that extent, reduce the Share Capital. The amount received by the company is not refunded.

When the said shares are forfeited the shareholder ceases to be a member of the company. He loses all his rights and interests that a shareholder might enjoy. And once his name is removed from the register of shareholders he also losses all the money he has already paid towards the share capital. Such money will not be refunded. So it is very important to be cautious before forfeituring the shares. Company must ensure to follow following requirements of a valid forfeiture.

1. The forfeiture should be in accordance with articles of the company.

2. Before such forfeiture is done a notice must be given to the shareholder. The notice must provide the shareholder with a minimum of 14 days to make the payment due, or his shares will be forfeited.

3. Even after such notice if the shareholder does not pay, then the shares will be canceled.

4. The Directors must pass a resolution declaring that his shares have been forfeited.

5. The right of forfeiture must have been excercised in good faith.

Surrender of Shares

Surrender of shares is a process in which a shareholder voluntarily returns their shares to the company, usually because they cannot pay for future calls on the shares. It is similar to forfeiture, but instead of the company taking action to reclaim the shares, the shareholder initiates the process.

It has the same effect as forfeiture and is subject to the same conditions.

Share Capital

In relation to a company limited by shares, the term capital means the ‘Share Capital’ i.e. the capital in terms of shares divided into specified number of shares each having a fixed value.

Share capital is the money a company raises by issuing common or preferred stock. The Share capital definition refers to the funds raised by an entity to issue shares to the general public. Simply put, share capital is the money contributed to a firm by its shareholders. It is a long-term capital source and facilitates smooth operations, profitability, and financial growth.

The Company’s Memorandum of Association mentions the maximum amount of share capital. The company may increase the maximum share capital with an amendment to its Memorandum of Association. Share capital is the par value of a company’s asset. The sale of shares to the general public generates funds for the business and is a primary source of capital finance.

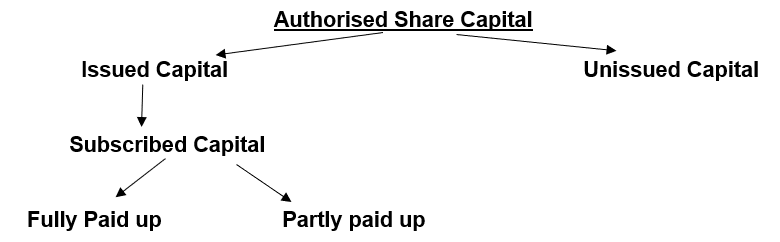

Authorised Capital: Authorised capital is the amount of the share capital in which a company is allowed to issue as per Memorandum of Association. The company is not supposed to raise more than the amount of capital as mentioned in the Memorandum of Association. It is also known as Registered or Nominal capital.

Issued Capital: It is that portion of the authorised capital which is usually circulated to the public for subscription comprising the shares. The authorised capital which is not offered to public is called as ‘unissued capital’.

Subscribed Capital: The subscribed capital is referred to as that part of issued capital that is subscribed by the company investors. It is the actual amount of capital that the investors have taken.

Called up Capital : The amount of share capital that the shareholders owe and are yet to be paid is known as called up capital. It is that part of the share capital that the company calls for payment.

Section 43 of The Companies Act, 2013 is related to Kinds of Share Capital :

The share capital of a company limited by shares shall be of two kinds, namely:–

(a) equity share capital–

(i) with voting rights; or

(ii) with differential rights as to dividend, voting or otherwise in accordance

with such rules as may be prescribed; and

(b) preference share capital:

Provided that nothing contained in this Act shall affect the rights of the preference shareholders who are entitled to participate in the proceeds of winding up before the commencement of this Act.

Explanation.– For the purposes of this section,–

(i) equity share capital, with reference to any company limited by shares, means all share capital which is not preference share capital;

(ii) preference share capital, with reference to any company limited by shares, means that part of the issued share capital of the company which carries or would carry a preferential right with respect to payment of dividends and repayments in case of winding up

Equity Shares

Equity shares are long-term financing sources for any company. These shares are issued to the general public and are non-redeemable in nature. Investors in such shares hold the right to vote, share profits and claim assets of a company.

Preference Shares

Preference shares give mainly two preferences to its holder. Firstly, assured fixed dividend secondly, when company goes into winding up, preference shareholders are paid back their capital amounts before the equity shareholders are paid.

Preference shares are of different types.

1. Cumulative Preference Shares

These shares entitles shareholders to receive dividends in arrears. So, when a company does not make sufficient profits in a yea, they pay cumulative dividends in the next year.

2. Non-cumulative Preference Shares

These shares do not accumulate dividends. So, if a company is in loss in a particular year, the pending dividends cannot be claimed by shareholders from future profits.

3. Redeemable Preference Shares

These preference shares are also known as callable preferred stock Typically, a company has the right to repurchase the shares it had issued to satisfy its own purpose. Consequently, the redeemable preference shares are repurchased at a fixed rate on a fixed date or by announcing the same in advance.

4. Irredeemable Preference Shares

This particular share cannot be redeemed or repaid during the active lifetime of a company.To elaborate, shareholders will have to wait until the company decides to wind up its current operations or liquidate the venture altogether to initiate the same. It makes the shares a perpetual liability for the company.

5. Participating Preference Shares

The said shares extend the right to participate in surplus profit during liquidation once the company in question has paid its other shareholders.

So, to elaborate, the participating preference shareholders receive a fixed rate of dividend and also have a share in the company’s extra earnings. Most individuals invest in participating preference shares of those companies which are more likely to generate profits.

Participating preference shareholders may have voting rights or authority over certain decisions pertaining to the sale of the business venture or crucial assets.

The shares may be cumulative, which means shareholders will receive the unpaid dividends before it is paid to the equity stockholders.

6. Non-participating Preference Shares

As the name suggests, non-participating preference shareholders do not have a share in the extra earnings or surplus assets during the liquidation of a company.

This type of share entitles its shareholders to receive only the pre-fixed dividends.

7. Convertible Preference Shares

Convertible shares are fundamentally those shares which enable holders to get them converted into equity shares at a fixed rate. Notably, these shares can only be converted after the expiry of a specified time and within a given period, as stated in the memorandum. Such shares help investors generate fixed earnings along with the opportunity to accrue higher returns frequently.

8. Non-convertible Preference Shares

Non-convertible shareholders cannot convert their shares into equity shares. Regardless, they enjoy the preferential benefit when it comes to accruing dividends or during company’s dissolution.

9. Adjustable-rate Preference Shares

The rate of dividend paid on this share is floating in nature and is heavily dependent on the prevailing market rates. It directly influences the amount of dividend received by the shareholders throughout the investment.

Bonus Shares

These types of equity shares are issued out of retained earnings of a business, wherein the profits are distributed among investors in the form of an additional stake in a company. Contrary to other types of equity instruments, bonus shares do not increase total market capitalisation value of a company. It just represents capitalisation of excess funds generated from production.

Rights Shares

These shares are issued by a company to premium investors at a discounted price as an invitation to increase its stake in the respective business. A firm only sells shares to rights for a stipulated time to raise the required finances to meet its expenditures incurred.

Good job on this article! I really like how you presented your facts and how you made it interesting and easy to understand. Thank you.