Contract of Indemnity – Indian Contract Act, 1872 – Law Notes

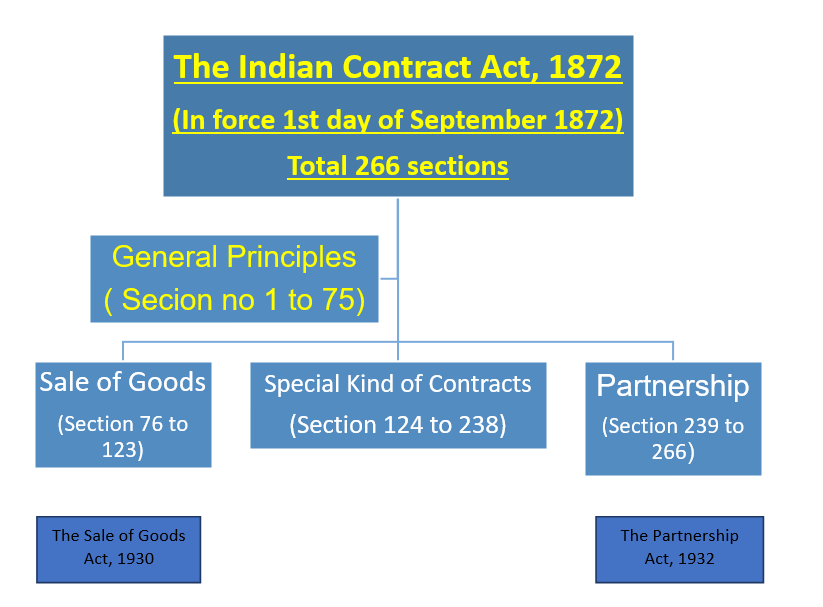

The Indian Contract Act, 1872

Principles for formation of contractual relations and to provide the remedial measures of recovery of damages in the event of one party’s failure to keep his contractual commitments.

Contract = Agreement + Enforceability

Agreement = Promise + Consideration

Promise = Offer + Acceptance.

Essential elements of contract :

- Number of parties at least two or more

- Offer and Acceptance

- Intention to create legal relationship

- Free Consent

- Possibility of performance

- Capacity to enter into contract ( Competent )

- Lawful object and lawful consideration.

- Consensus ad idem (Meeting of the minds)

- Agreement should not be expressely declared void by law.

- Legal Formality.

Some of the key words :

S2(a) When one person signifies to another his willingness to do or to abstain from doing anything, with a view to obtaining the assent of that other to such act or abstinence, he is said to make a proposal.

S2(b) When the person to whom the proposal is made signifies his assent thereto, the proposal is said to be accepted.

A proposal, when accepted, becomes a promise.

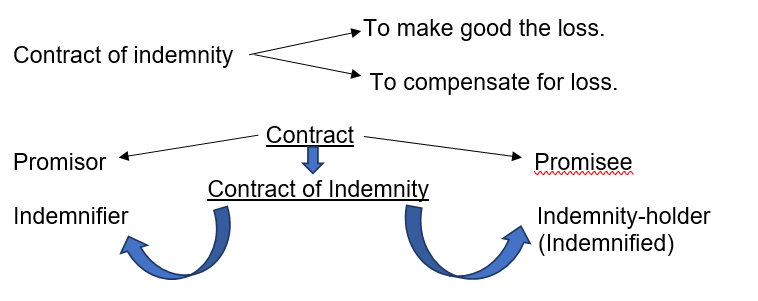

S2(c) The person making the proposal is called the “promisor”, and the person accepting the proposal is called the “promisee”.

S2(d) When, at the desire of the promisor, the promisee or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something, such act or abstinence or promise is called a consideration for the promise.

S2(g) An agreement not enforceable by law is said to be void.

S2(i) An agreement which is enforceable by law at the option of one or more of the parties thereto, but not at the option of the other or others, is a voidable contract.

S2(j) A contract which ceases to be enforceable by law becomes void when it ceases to be enforceable.

How Agreement becomes Contract ?

Agreement + Essential Elements = Contract ( A + EE = C)

What is the difference between Loss & Damage in general ?

Loss : Whatever is gone from us which we wish to retain is a loss. The act or fact of losing. In some instances it may mean that which can never be recovered. Eg : Loss in our property, or every other object of possession.

Damage : Whatever renders an object less serviceable or valuable by any external violence is a damage. The word damages constitute the sum of money, claimed or awarded to be paid in compensation for loss or injury sustained. ( damage resulting from damage is consequential damage.)

Indemnity meaning (क्षतिपूर्ती) (Concise Law Dictionary) : Formal legal acceptance of responsibility against damage or loss.

Indemnify : To make good a loss which one person has suffered in consequence of the act or default of another.

Section 124 and section 125 of The Indian Contract Act, 1872 are related to Contract of Indemnity. Before we refer Indemnity let’s have look on Contingent Contract.

S 31 “Contingent contract” defined

A “contingent contract” is a contract to do or not to do something, if some event, collateral to such contract, does or does not happen.

S32. Enforcement of contracts contingent on an event happening

Contingent contracts to do or nor to do anything if an uncertain future event happens, cannot be enforced by law unless and until that event has happened.

If the event becomes impossible, such contracts become void.

S33. Enforcement of contract contingent on an event not happening

Contingent contracts to do or not to do anything if an uncertain future event does not happen, can be enforced when the happening of that event becomes impossible, and not before.

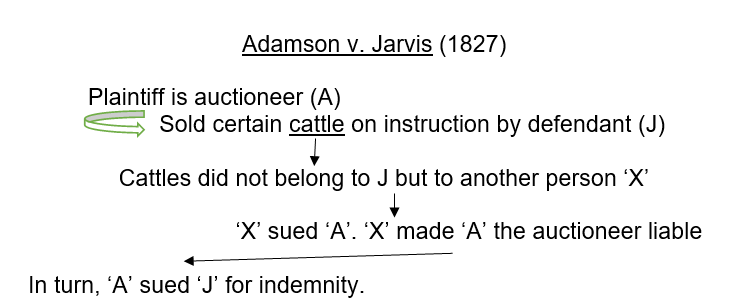

Court held : ‘A’ acted at ‘J’s request…entitled to assume that B will indemnify him if something turned out to be wrong.

The promise may be express or it may be implied from the circumstances of case.

The English definition of indemnity is wide enough to include a promise of indemnity against loss arising from any cause whatsoever. (eg fire)

But the definition of ‘indemnity’ in section 124 of Indian Contract Act is somewhat narrower. It is like this :

“Contract of indemnity” defined (Section 124)

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a “contract of indemnity”.

Illustration :

A contracts to indemnify B against the consequences of any proceedings which C may take against B in respect of a certain sum of 200 rupees. This is a contract of indemnity.

(Meaning of illustration is that if B is ordered to pay Rs. 200/- to C and also the cost of suit, A shall be liable to pay B the full amount.

Example :

Mr. AB having 10,000 shares of Company ‘R’, lost the share certificates. He approaches company to issue him duplicate shares.

Company agrees to issue duplicate but ask for a bond stating that, in case any loss or damage is caused to company because of the act of Mr. AB, he will compensate.

“ The main principle behind indemnity is to put person back to the place he was…he will be restored to original position. Person will not make any profit or loss out of it. So,

Essentials of Indemnity :

- It must contain all the essentials of a valid contract.

- The Promisee or the indemnified must have suffered a loss.

- Prmisor is or Indemnifier is primarily liable.

Why is the general insurance called contract of indemnity ?

When the purpose of insurance is to protect against loss of property due to an accident it is known as general insurance. Through this contract the insured get promised of compensation against loss of property due to specific probable accidents mentioned in the contract in lieu of payment of premium at regular intervals. compensation will be paid only if the loss take place due to any of the events mentioned in the policy documents. If the loss occur due to any other event not mentioned in the, no compensation will be paid. Similarly if their is no loss of property their is no question of giving any compensation. For this reason general insurance is known as the ‘contract of indemnity’.

Why does life insurance is not an indemnity contract ?

How can someone assess the value of someone’s life? One can assess value of car, assess value of building. But value of life cannot be calculated.

Right of indemnity-holder when sued (Section 125)

The promisee in a contract of indemnity, acting within the scope of his authority, is entitled to recover from the promisor-

(1) all damages which he may be compelled to pay in any suit in respect of any matter to which the promise to indemnify applies;

(2) all costs which he may be compelled to pay in any such suit, if in bringing or defending it, he did not contravene the orders of the promisor, and acted as it would have been prudent for him to act in the absence of any contract of indemnity, or if the promisor authorized him to bring or defend the suit;

(3) all sums which he may have paid under the terms of any compromise of any such suit, if the compromise was not contrary to the orders of the promisor, and was one which it would have been prudent for the promisee to make in the absence of any contract of indemnity, or if the promisor authorized him to compromise the suit.

Commencement of liability : When does the indemnifier become liable to pay, or, when is the indemnity holder is entitled to recover his indemnity.

The original English rule was that, only after the indemnity holder had suffered actual loss by paying off the claim. But the law is now different.

After the case of “Gajanan Moreshwar v. Moreshwar Madan”, there is a change in this English rule. It was held in this case that, if his liablity had become absolute, then he was entitled either to get the indemnifier to pay off the claim or to pay into court sufficient money which would constitute a fund for paying off the claim whenever it was made.