Types of Companies – – The Companies Act, 2013 – Law Notes

TYPES OF COMPANIES

The three basic types of companies which may be registered under Act are : Section 3(1) : A Company may be formed for any lawful purpose.

Private Companies (Min 2 members)

Public Companies (Min 7 members)

One Person Company (to be formed as Private Limited)(Min 1 person)

Section 3(2) : A company formed under sub-section (1) may be either— (a) a company limited by shares; or

(b) a company limited by guarantee; or

(c) an unlimited company.

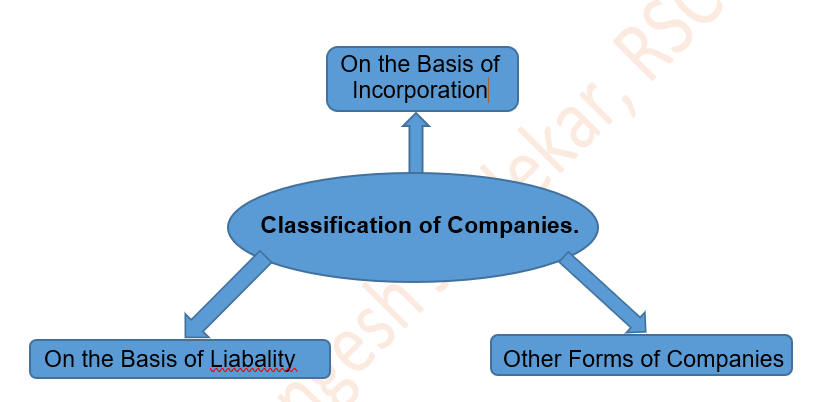

(A) Classification of Companies on the basis of incorporation :

1. Charter Company :-

It may be better understood as the company born out of the authorization of the sovereign or the crown. This was the mode of incorporation which was followed earlier to the Registration under the Companies Act. A charter is granted by the crown to the people requesting to form a cooperative or a company.

To name a few, The East India Company (1600) were formed by the means of charters passed by the then Crown of England. The authorization given by the sovereign gives legal existence to these companies by means of the body of the charter.

This mode of incorporation is no more recognised in any Companies Act to incorporate new Companies.

2. Statutory Company :-

As the name suggests, these are the companies that are formed by the means of a special statute passed by the Parliament or the State Legislature. The examples of statutory companies in India are the Reserve bank of India, the Life Insurance Corporation of India Act, etc.

The Statutory origins of these companies provide power to such companies to be bound by their own statute, i.e. whenever there is any dispute between statute under which these companies were formed and the Companies Act 2013, the statute being special legislation persists over the general law of Companies Act. The parliaments both State and Centre are empowered to make such legislation for incorporation under the power endowed to them by the Constitution of India.

3. Registered Companies:

Companies registered under the CA, 2013 or under any previous Company Law are called registered companies Such companies comes into existence when they are registered under the Companies Act and a certificate of incorporation is granted to it by the Registrar.

B. Types of Company on the basis of Liability :-

1. Companies limited by shares :

A company that has the liability of its members limited by the memorandum to the amount, if any, unpaid on the shares respectively held by them is termed as a company limited by shares.

The liability can be enforced during existence of the company as well as during the winding up. Where the shares are fully paid up, no further liability rests on them.

For example, a shareholder who has paid 75 on a share of face value 100 can be called upon to pay the balance of 25 only. Companies limited by shares are by far the most common and may be either public or private.

2. Companies limited by guarantee :

Company limited by guarantee is a company that has the liability of its members limited to such amount as the members may respectively undertake, by the memorandum, to contribute to the assets of the company in the event of its being wound-up. In case of such companies the liability of its members is limited to the amount of guarantee undertaken by them.The members of such company are placed in the position of guarantors of the company’s debts up to the agreed amount.

3. Unlimited Liability Companies :

A company not having a limit on the liability of its members is termed as unlimited company. Here the members are liable for the company’s debts in proportion to their respective interests in the company and their liability is unlimited.

Such companies may or may not have share capital. They may be either a public company or a private company.

C. Other Forms of Companies :

This type of classification includes for example, Sec 8 Company, Government Company, Foreign Companies, Holding & Subsidiary Companies, Associate/Joint venture Company, Investment Company, Producer Company, Dormant Companies.

: Private Company :

Sec 2(68) :―Private Company means a company having a minimum paid-up share capital as may be prescribed, and which by its articles,— (i) restricts the right to transfer its shares;

(ii) except in case of One Person Company, limits the number of its members to two hundred,

Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member:

Provided further that :— (Exclusion from Members)

(A) persons who are in the employment of the company; and

(B) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased, shall not be included in the number of members; and,

(iii) prohibits any invitation to the public to subscribe for any securities of the company;

Section 3(1) of the CA, 2013 – Private Company may be formed for any lawful purpose by 2 or more persons.

Section 149(1) of the CA, 2013 – Every Private company shall have minimum 2 director in its Board.

Section 4(1)(a) of the CA, 2013 – A private company is required to add the words “Private Ltd” at the end of its name.

Important Points :-

1. The aforesaid definition of private limited company specifies the restrictions, limitations and prohibitions, which must be expressly provided in the articles of association of Pvt. Ltd Co.

2. A private company may issue debentures to any number of persons, the only condition being that an invitation to the public to subscribe for debentures is prohibited.

3. As per the proviso to Section 14(1), Where a company being a private company alters its articles in such a manner that they no longer include the restrictions and limitations which are required to be included in the articles of a private company under this Act, the company shall, as from the date of such alteration, cease to be a private company

4. A private company can only accept deposit from its members in accordance with section 73 of the CA, 2013.

Conversion of Private company into public company :-

1. Conversion by default :- The privilages and exemptions can be enjoyed by a private company as long as the requirement of section 2(68) is complied with. When a default is made in complying with any of those provision, the company shall cease to be entitled to the privileges and exemptions conferred by or under the Act and then the provision of the Act would apply as if it were not a private company.

2. Conversion by choice :- (Section 14) :- A private company may at any time pass a special resolution deleting from its articles the requirement of section 2(68) and then from the date of its alteration it shall become a public company.

All India Reporter Ltd. v. Ramchandra : The conversion of a private company into a public company and vice-versa, does not change the identity of the company, only its nature is changed. A Pvt. Ltd. Co. can be converted into a public ltd co. by merely changing two or three articles in AOA; the original AOA continue to be operative. Such an alteration does not affect the identity of the company.

Privilages of Private Company :-

1. Section 67(2) :- Financial assistance can be given to its employees for purchase of or subscribing to its own shares or shares in its holding company.

2. Section 121(1) :- Need not prepare a report on the AGM.

3. Section Section 149(1) :- Private company need not have more than two directors.

4. Section 149(4) :- Need not appoint independent directors on its Board.

5. Section 152(6) :- A proportion of directors need not retire every year.

6. Section 164(3) :- Additional grounds for disqualification for appointment as a director may be specified by the company in its articles.

7. Section 167(4) :- Additional grounds for vacation of office of a director may be provided in the Articles.

8. All the directors may be appointed by a single resolution.

9. The number of directors can be increased without the consent of the Central Government.

10. Persons holding an office of profit can be appointed as directors of a company without passing a special resolution.

11. Prohibition regarding granting of loans by companies to directors does not apply.

12. A private company is not required to constitute an audit committee of the Board.

13. A private company need not hold a statutory meeting and file a statutory report with the Registrar.

14. A private company is required to file copies of balance-sheet and profit and loss account to the Registrar of Companies but no person other than member of the company is entitled to inspect the balance-sheet and profit and loss account.

Powers of Central Government to amend privilages granted to private companies (sec 462(1)) :-

The Central Government may in the public interest, by notification direct that any of the provisions of this Act,—

(a) shall not apply to such class or classes of companies; or

(b) shall apply to the class or classes of companies with such exceptions, modifications and adaptations as may be specified in the notification.

: Section 8 Company :

A company is referred to as Section 8 Company when it registered as a Non-Profit Organization (NPO) i.e. when it has motive of promoting arts, commerce, education, charity, protection of environment, sports, science, research, social welfare, religion and intends to use its profits (if any) or other income for promoting these objectives.

The income of NPO can not be used for paying out dividends to the company’s members and has to be for the promotion of charitable objectives. Such companies obtain an incorporation certificate from the central government and are liable to adhere to the rules specified by the government.

According to the rules, failure to comply with the responsibilities stated by the Central Government may lead to the winding up of the company on the orders of government. Besides, strict legal action will be taken against all the members of the company if the objectives laid down by the company proves to be bogus.

: One Person Company :

Under the 1956 Act, there was no concept of a company with only one member. The Companies Act, 2013 has introduced the concept of a ‘One Person Company’.

With the implementation of the Companies Act, 2013, a single national person can constitute a Company, under the One Person Company (OPC) concept.

As per provision of Section 2(62) of the Companies Act, 2013,

‘One Person Company’ means a company which has only one person as a member.

Formation of OPC is same as per the Section 3 but conditions are prescribed in proviso to Section 3 which is as under

(Section 3 : Formation of company.— (1) A company may be formed for any lawful purpose by— (a) seven or more persons, where the company to be formed is to be a public company; (b) two or more persons, where the company to be formed is to be a private company; or (c) one person, where the company to be formed is to be One Person Company that is to say, a private company, by subscribing their names or his name to a memorandum and complying with the requirements of this Act in respect of registration).

Provided that, the memorandum of One Person Company shall indicate the name of the other person, with his prior written consent in the prescribed form, who shall, in the event of the subscriber‘s death or his incapacity to contract become the member of the company and the written consent of such person shall also be filed with the Registrar at the time of incorporation of the One Person Company along with its memorandum and articles

Provided further that such other person may withdraw his consent in such manner as may be prescribed

Provided also that the member of One Person Company may at any time change the name of such other person by giving notice in such manner as may be prescribed

Provided also that it shall be the duty of the member of One Person Company to intimate the company the change, if any, in the name of the other person nominated by him by indicating in the memorandum or otherwise within such time and in such manner as may be prescribed, and the company shall intimate the Registrar any such change within such time and in such manner as may be prescribed

Provided also that any such change in the name of the person shall not be deemed to be an alteration of the memorandum.

(By virtue of section 3(2), an OPC may be formed either as (a) a company limited by shares; or (b) a company limited by guarantee; or (c) an unlimited company.)

Important points :-

1. Only a natural person who is an Indian citizen and resident in India, who has stayed in India for a period of not less than one hundred and eighty two days during the immediately preceding one calender year, shall be eligible to incorporate a OPC.

2. Minor not to become Member or Nominee in OPC :No minor shall become member or nominee of the OPC.

3. OPC cannot be incorporated or converted into a company under section 8 of the Act.

4. OPC cannot carry out Non-Banking Financial Investment activities including investment in securities of any body corporate.

5. OPC cannot convert voluntarily into any kind of company unless two years have expired from the date of incorporation.

6. As per section 193(2), the company shall inform the Registrar about every contract entered into by the company and recorded in the minutes of the meeting ot its Board of Directors under sub-section (1) within a period of fifteen days of the date of approval by the Board of Directors.

7. Individual member deemed to be First Director :- As per section 152(1) in case of a One Person Company an individual being member shall be deemed to be its first director until the director or directors are duly appointed by the member in accordance with the provisions of this section.

Advantages of One Person Company :-

It gives the individual entrepreneur all the benefits of a company, which means they will get credit, bank loans, access to market, limited liability, and legal protection available to companies.

Further, the amount of compliance by a one person company is much lesser in terms of filing returns, balance sheets, audits etc.

The concept of OPC would provide tremendous opportunities for small businessmen and traders, including those working in areas like handloom, handicrafts etc.

: Public Company :

A public company means a company which (a) is not a private company; (b) has a minimum paid-up share capital as may be prescribed:

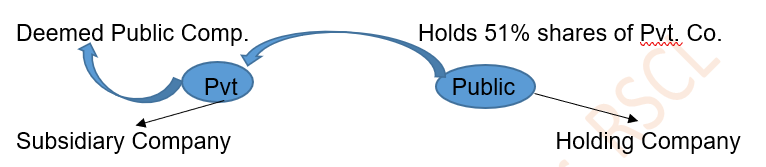

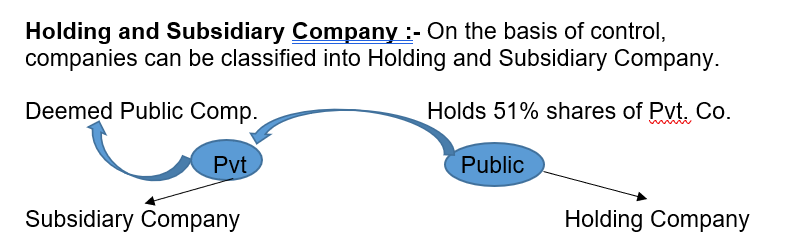

Provided that a company which is a subsidiary of a company, not being a private company, shall be deemed to be public company for the purposes of this Act even where such subsidiary company continues to be a private company in its articles

Public Company : May be formed for any lawful purpose by seven or more persons. It may be said to be an association of not less than 7 members, which is registered under Act. In principle, any one from the public who is willing to pay price may acquire shares in or debentures.

Shares of Public Company is freely transferable :- As per sec. 58(2), The securities or other interest of any member in public company shall be freely transferable. However, any contract or arrangement between two or more persons in respect of transfer of securities shall be enforceable as a contract.

The concept of free transferability of shares in a public and private company is discussed in the case of Bajaj Auto Ltd. v. Wetern Maharashtra Development Corpn. Ltd. It was held that, the Companies Act, makes a clear distinction in regard to transferability of shares relating to private and public companies. By definition, a ‘private company’ is a company, which restricts the right to transfer its shares. In the case of ‘public company’, the Act provides that, the shares or debentures and any interest therein, of a company, shall be freely transferable.

Conversion of Public company into Private Company :

A public company may convert itself into private company by passing a special resolution through which it may place the restriction in its articles as mentioned in section 2(68).

Further, section 14(1) provides that, no alteration made in the articles which has the effect of converting a public into private company shall have effect unless approved by the Tribunal.

Section 3(2) A company formed under sub-section (1) may be either— (a) a company limited by shares; section 2(22) or

(b) a company limited by guarantee; section 2(21) or

(c) an unlimited company; section 2(92).

Section 2(22) ― Company limited by shares means a company having the liability of its members limited by the memorandum to the amount, if any, unpaid on the shares respectively held by them.

Section 2(21) ― Company limited by guarantee means a company having the liability of its members limited by the memorandum to such amount as the members may respectively undertake to contribute to the assets of the company in the event of its being wound up.

Section 2(92) ― Unlimited company means a company not having any limit on the liability of its members.

Private Limited vs Public Limited Company

Minimum number

To start a public limited corporation, at least seven people must be present. A private limited business can be formed with just two people. As the name suggests, public limited companies are bound to have more people in the company as compared to private limited companies.

Maximum number of people

The maximum number of shareholders in a public limited company is unlimited. In a private limited business, the maximum number of shareholders is two hundred subjected to some orders, excluding the firm’s previous and present workers.

Publication of the prospectus

A public limited business can issue shares to the general public. Before issuing shares, it must either issue a prospectus or file a statement in place of a prospectus.

A private limited corporation, by law, has no authority to invite the public to its meetings and, as a result, cannot produce a prospectus. They can’t get the public to buy stock in the company.

In the meetings of a public limited company, the stockholders take part but the case isn’t the same for the private limited ones as per law.

Transfer of shares

In a public limited corporation, it is simple to transfer shares. Members’ rights to transfer their shares in a private limited corporation are limited by the Articles of Association.

Meeting required by law

Within six months after the start of operations, a public limited company must conduct a statutory meeting. The statutory report should be filed with the Registrar of Companies. A statutory meeting is not required for a private limited corporation as per the laws made for it.

The number of directors

In the management of a public limited corporation, there should be at least three directors. A private limited corporation must have at least two directors to manage the company.

Director’s approval

In a public limited corporation, the directors’ written agreement to function as such is required. In a private limited corporation, the powers of directors decrease. For any such thing, the permission of the directors is not required.

Directors’ retirement

In a public limited corporation, at least two-thirds of the directors must depart from management via rotation. In a private limited business, there is no requirement to retire. This can be because of the less no. of directors as advised by the law.

The company’s name

The term “Limited” must be added to the end of the name of a public limited business. The words “Private Limited” must be added to the end of the name of a private limited corporation.

Annual Report

An annual report must be filed with the Registrar of Companies by a public limited company. For a private limited firm, it is not required. No annual report needs to be filed in the case of it as per law.

Directors’ compensation

The payment of salary to directors of a public limited company is subject to specific regulations. In a private limited firm, there are no such limitations.

Quorum for a meeting

A quorum of 5 people is necessary for a meeting of a public business. In the case of a private firm, the quorum consists of two people.

: Other Companies :

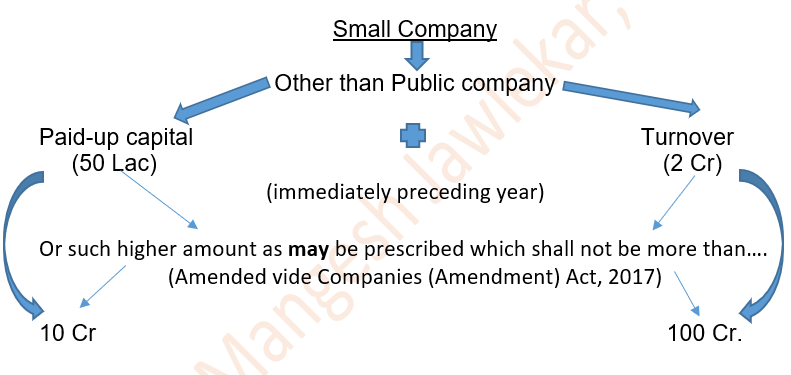

Small Company : Section 2 (85) :- “Small company‘‘ means a company, other than a public company,—

(i) paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than five crore rupees; or

(ii) turnover of which as per its last profit and loss account does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than twenty crore rupees:

Provided that nothing in this clause shall apply to :—

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act;

Exclusions

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act;

Privileges of Small Company :

As per Sec (92) Every company shall prepare a return (hereinafter referred to as the annual return) in the prescribed form containing the particulars as they stood on the close of the financial year. But in relation to One Person Company and small company, the annual return shall be signed by the company secretary, or where there is no company secretary, by the director of the company.

As per Sec 2(40) :― “financial statement” in relation to a company, with respect to One Person Company, small company and dormant company, may not include the cash flow statement

(A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.).

As per section 173, Every company shall hold the first meeting of the Board of Directors within thirty days of the date of its incorporation and thereafter hold a minimum number of four meetings of its Board of Directors every year in such a manner that not more than one hundred and twenty days shall intervene between two consecutive meetings of the Board.

But as per section 173(5), A One Person Company, small company and dormant company shall be deemed to have complied with the provisions of this section if at least one meeting of the Board of Directors has been conducted in each half of a calendar year and the gap between the two meetings is not less than ninety days

Powers of Central Government to amend privileges granted to small companies (sec 462(1)) :-

The Central Government may in the public interest, by notification direct that any of the provisions of this Act,—

(a) shall not apply to such class or classes of companies; or

(b) shall apply to the class or classes of companies with such exceptions, modifications and adaptations as may be specified in the notification.

Government Companies :

Section 2(45) :-”Government company” means any company in which not less than fifty-one per cent. of the paid-up share capital is held by the

Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments, and includes a company which is a subsidiary company of such a Government company.

So, to constitute a Government Company, more than 50 % of share capital should be held by 1. Central Government 2. State Government

3. Partly by State and Partly by Central Government.

(Note : A subsidiary of Government Company is also a Govt. Comp.)

Hindustan Steel Works Construction Co. Ltd v. State of Kerala : In-spite of control of the Government, the Government company is neither a Government department nor a Government establishment.

A Govt. Co. cannot claim tax exemption on its property as income of the State are exempted from the Union Taxation under Article 289 of the Indian Constitution even though it is wholly controlled by the State Govt., it had a separate entity and its income was not the income of State Govt.

(Andhra Pradesh Road Transport Corporation v. ITO). The Court, observed that the companies which are incorporated under the Companies Act, have a corporate personality of their own, distinct from that of the Government of India. The land and buildings are vested in and owned by the companies, the Government of India only owns the share capital.

The employees of a Govt. Co. are not the employees of the Central or State Government.

A Govt. Co. may, in fact, be wound up like any other company registered under the Companies Act.

It may become insolvent or be unable to pay its debt because it does not mean that, the Government holding the shares, viz, Central or State, as the case may be, has become bankrupt.

All the Companies registered under the Companies Act, 2013 including Government Companies are required to maintain books of account and other relevant books and papers and financial statement for every financial year which give a true and fair view of the state of the affairs of the Company and get the book of accounts audited. Therefore, after the incorporation of a Company, an auditor is required to be appointed by the Company.

As per Section 139(7), in case of a Government Company or any other Company-owned or controlled, directly or indirectly, by the Central Government, or by any State Government, or Governments, or partly by the Central Government and partly by one or more State Governments, the first auditor shall be appointed by:

- The Comptroller and Auditor-General of India within sixty days from the date of registration of the Company and in case the Comptroller and Auditor-General of India does not appoint such auditor within the said period;

- The Board of Directors of the Company shall appoint such auditor within the next thirty days and In the case of failure of the Board to appoint such auditor within the next thirty days;

- The Board shall inform the members of the Company who shall appoint such auditor within the sixty days at an Extraordinary General Meeting, who shall hold office till the conclusion of the first Annual General Meeting.

Foreign Companies : Chapter XXII (Sec 379 to Sec 393)

( Section 2(42)) :- ”Foreign company” means any company or body corporate incorporated outside India which—

(a) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and

(b) conducts any business activity in India in any other manner.

Section 380(1) : Documents, etc., to be delivered to Registrar by foreign companies.—

Every foreign company shall, within thirty days of the establishment of its place of business in India, deliver to the Registrar for registration—

(a) a certified copy of the charter, statutes or memorandum and articles, of the company or other instrument constituting or defining the constitution of the company and, if the instrument is not in the English language, a certified translation thereof in the English language;

(b) the full address of the registered or principal office of the company; (c) a list of the directors and secretary of the company containing such particulars as may be prescribed;

(d) the name and address or the names and addresses of one or more persons resident in India authorised to accept on behalf of the company service of process and any notices or other documents required to be served on the company;

(e) the full address of the office of the company in India which is deemed to be its principal place of business in India;

(f) particulars of opening and closing of a place of business in India on earlier occasion or occasions;

(g) declaration that none of the directors of the company or the authorised representative in India has ever been convicted or debarred from formation of companies and management in India or abroad; and (h) any other information as may be prescribed.

Section 381 : Accounts of foreign company :— (1) Every foreign company shall, in every calendar year,—

(a) make out a balance sheet and profit and loss account in such form, containing such particulars and including or having annexed or attached thereto such documents as may be prescribed; and

(b) deliver a copy of those documents to the Registrar

(3) Every foreign company shall send to the Registrar along with the documents required to be delivered to him under sub-section (1), a copy of a list in the prescribed form of all places of business established by the company in India as at the date with reference to which the balance sheet referred to in sub-section (1) is made out.

Section 376 :- Power to wind up foreign companies, although dissolved :

Where a body corporate incorporated outside India which has been carrying on business in India, ceases to carry on business in India, it may be wound up as an unregistered company under this Part, notwithstanding that the body corporate has been dissolved or otherwise ceased to exist as such under or by virtue of the laws of the country under which it was incorporated.

Section 384 :- Applicability of Provisions of Companies Act to Foreign Company :-

Debentures :- The provisions of section 71 relating to Debentures shall apply to foreign company.

Filing of Annual Return :- The provisions of section 92 regarding filing filing of annual returns shall apply to a foreign company as they apply to a company incorporated in India.

The provisions of section 128 shall apply to a foreign company to the extent of requiring it to keep at its principal place of business in India, the books of account referred to in that section, with respect to monies received and spent, sales and purchases made, and assets and liabilities, in the course of or in relation to its business in India.

Section 379 :- Application of Act to foreign companies :—

Where not less than fifty per cent of the paid-up share capital, whether equity or preference or partly equity and partly preference, of a foreign company is held by one or more citizens of India or by one or more companies or bodies corporate incorporated in India, or by one or more citizens of India and one or more companies or bodies corporate incorporated in India, whether singly or in the aggregate, such company shall comply with the provisions of this Chapter and such other provisions of this Act as may be prescribed with regard to the business carried on by it in India as if it were a company incorporated in India.

Section 393 :- Company‘s failure to comply with provisions of this Chapter not to affect validity of contracts, etc :— Any failure by a company to comply with the provisions of this Chapter shall not affect the validity of any contract, dealing or transaction entered into by the company or its liability to be sued in respect thereof, but the company shall not be entitled to bring any suit, claim any set-off, make any counter-claim or institute any legal proceeding in respect of any such contract, dealing or transaction, until the company has complied with the provisions of this Act applicable to it.

Section 2(27) :―”Control” shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner;

Section 2(46) ―”Holding company”, in relation to one or more other companies, means a company of which such companies are subsidiary companies.

Explanation : For the purpose of this clause, the expression “Company” includes any body corporate; (inserted vide 2017 amendment.)

Section 2(87) :―”Subsidiary Company” or ―”Subsidiary”,

in relation to any other company (that is to say the holding company), means a company in which the holding company—

(i) controls the composition of the Board of Directors; or

(ii) exercises or controls more than one-half of the total share capital either at its own or together with one or more of its subsidiary companies:

Provided that such class or classes of holding companies as may be prescribed shall not have layers of subsidiaries beyond such numbers as may be prescribed.

Explanation.—For the purposes of this clause,—

(a) a company shall be deemed to be a subsidiary company of the holding company even if the control referred to in sub-clause (i) or sub-clause (ii) is of another subsidiary company of the holding company;

(b) the composition of a company‘s Board of Directors shall be deemed to be controlled by another company if that other company by exercise of some power exercisable by it at its discretion can appoint or remove all or a majority of the directors;

(c) the expression ―company, includes any body corporate;

(d) “layer” in relation to a holding company means its subsidiary or subsidiaries.

Section 19 :- Subsidiary company not to hold shares in its holding company :— No company shall, either by itself or through its nominees, hold any shares in its holding company and no holding company shall allot or transfer its shares to any of its subsidiary companies and any such allotment or transfer of shares of a company to its subsidiary company shall be void:

Provided that nothing in this sub-section shall apply to a case—

(a) where the subsidiary company holds such shares as the legal representative of a deceased member of the holding company; or

(b) where the subsidiary company holds such shares as a trustee; or

(c) where the subsidiary company is a shareholder even before it became a subsidiary company of the holding company

Provided further that the subsidiary company referred to in the preceding proviso shall have a right to vote at a meeting of the holding company only in respect of the shares held by it as a legal representative or as a trustee, as referred to in clause (a) or clause (b) of the said proviso.

Section 129 : Where a company has one or more subsidiaries, it shall, in addition to financial statements prepare a consolidated financial statement of the company and of all the subsidiaries in the same form and manner as that of its own which shall also be laid before the annual general meeting of the company.

Provided that the company shall also attach along with its financial statement, a separate statement containing the salient features of the financial statement of its subsidiary or subsidiaries in such form as may be prescribed.

Provided further that the Central Government may provide for the consolidation of accounts of companies in such manner as may be prescribed.

Explanation— the word “subsidiary” shall include associate company and joint venture.

Under section 128, the books of account and other books and papers maintained by a company must be kept open for inspection at the registered office of the company during business hours. However, in case of a subsidiary of the company, such inspection can be done only by a person authorised in this behalf by a resolution of the Board of Directors.

Associate Company :

Section 2(6) : ―”Associate Company”, in relation to another company, means a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company

Revised Explanation to section 2(6) inserted vide Companies (Amendment) Act, 2017 :

Explanation :—For the purposes of this clause,

(a) “significant influence” means control of at least twenty per cent. of total share capital, or of business decisions under an agreement.

(b) the expression ‘joint venture’ means a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement.

(As per Section 2(27) of the Companies Act, 2013, the word “control” shall include the right to appoint a majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner).

Meaning, if an entity/person owns more than 20% of the total share capital of say ‘Company A’, or if an entity or a person has the right to appoint a majority of the directors in Company A through any agreement (shareholders agreement or others) or if there exists any agreement that allows the entity/person to control key decisions of Company A, then such entity/person is considered an associated party to the Company A.

(Mahindra and Mahindra Limited has Tech Mahindra Ltd. as its Associate Company with 26.04% holding (as per Annual Report 2019-20).).

This concept of ‘associate company’ has been introduced by the 2013 Act.

Investment Companies :

Section 186 (explanation a) :The expression ―”Investment company” means a company whose principal business is the acquisition of shares, debentures or other securities.

By an investment company, we generally mean a company, which is responsible for issuing securities as well as is primarily involved in the investment business. They normally invest the money received from their investors and every investor shares the profit or the losses that is proportionate to the interest of the investor in that company. The performances of such companies are mostly based on the performance of the different kinds of assets and the securities, which they own.

Eg : Larsen & Toubro Mutual Fund.

Dormant Companies :

Section 455 (1) :-The Companies Act, 2013 has recognised a new set of companies called as dormant companies.

Section 455 (1) :- Where a company is formed and registered under this Act for a future project or to hold an asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar in such manner as may be prescribed for obtaining the status of a dormant company.

Explanation.—For the purposes of this section,—

(i) ‘inactive company’ means a company which has not been carrying on any business or operation, or has not made any significant accounting transaction during the last two financial years, or has not filed financial statements and annual returns during the last two financial yrs;

(ii) ‘significant accounting’ transaction‖ means any transaction other than

(a) payment of fees by a company to the Registrar;

(b) payments made by it to fulfil the requirements of this Act or any other law;

(c) allotment of shares to fulfil the requirements of this Act; and

(d) payments for maintenance of its office and records.

(It means if a company is not having any transactions except to maintain and run company to comply with Statutory requirement, then the company is said to be inactive company.

Certain provisions relating ‘Dormant Companies’ :

Sec 455 (2) : The Registrar on consideration of the application shall allow the status of a dormant company to the applicant and issue a certificate in such form as may be prescribed to that effect.

Sec 455 (3) : The Registrar shall maintain a register of dormant companies in such form as may be prescribed.

Sec 455 (4) : In case of a company which has not filed financial statements or annual returns for two financial years consecutively, the Registrar shall issue a notice to that company and enter the name of such company in the register maintained for dormant companies.

Sec 455 (5) : A dormant company shall have such minimum number of directors, file such documents and pay such annual fee as may be prescribed to the Registrar to retain its dormant status in the register and may become an active company on an application made in this behalf accompanied by such documents and fee as may be prescribed.

Sec 455 (6) : The Registrar shall strike off the name of a dormant company from the register of dormant companies, which has failed to comply with the requirements of this section.

Producer Companies :

The Companies (Amendment) Act, 2002, which amended the 1956 Act, had introduced the concept of a ‘producer company’ by inserting new provisions relating to such companies.

Section 465, of the 2013 Act provides for Repeal of certain enactments and savings :—

(1) The Companies Act, 1956 (1 of 1956) and the Registration of Companies (Sikkim) Act, 1961 (Sikkim Act 8 of 1961) (hereafter in this section referred to as the repealed enactments) shall stand repealed: Provided, that the provisions of Part IX A of the Companies Act, 1956 shall be applicable mutatis mutandis to a Producer Company in a manner as if the Companies Act, 1956 has not been repealed until a special Act is enacted for Producer Companies

(mutatis mutandis : making necessary alterations while not affecting the main point at issue…..used when comparing two or more cases or situations.)

The concept of Producer Company in India was introduced to allow cooperatives to function as a corporate entity under the Ministry of Corporate Affairs.

The Companies Act defines Producer as any person engaged in any activity connected with or relatable to any primary produce (Produce: “things that have been produced or grown, especially by farming”). A Producer Company is thus a body corporate having an object that is one or all of the following:

- production, harvesting, procurement, grading, pooling, handling, marketing, selling, the export of primary produce of the Members or import of goods or services for their benefit.

Further, the Producer Company must deal primarily with the produce of its active Members and must allow to carry on any of the following activities by itself or through other entities – on behalf of the members.

- processing including preserving, drying, distilling, brewing, vinting, canning and packaging of the produce of its Members;

- manufacture, sale or supply of machinery, equipment or consumables mainly to its Members;

- providing education on the mutual assistance principles to its members and others;

- rendering technical services, consultancy services, training, research and development and all other activities for the promotion of the interests of its Members;

- generation, transmission and distribution of power, revitalisation of land and water resources, their use, conservation and communication relatable to primary produce;

- insurance of producers or their primary produce;

- promoting techniques of mutuality and mutual assistance;

- welfare measures or facilities for the benefit of Members as may be decided by the Board;

- any other activity, ancillary or incidental to any of the activities which may promote the principles of mutuality and mutual assistance amongst the Members in any other manner;

- financing of procurement, processing, marketing or other activities which include extending of credit facilities or any other financial services to its Members.

Important points :

- Any 10 or more producers (individuals) can join together to form a production company but there is no upper limit on the number of members.Or,

- any 2 or more producer institutions can form a producer company.

- A minimum capital of Rs. 500,000 is required to incorporate a producer company.

- There should be a minimum of 5 directors (maximum of 15) in a producer company.

- It can never be converted into a public company however it can be converted into a multi-state co-operative society.

- The process of registering a Producer Company is similar to that of a Private Limited Company.