Charges, Types of Charges and Crystallisation of Charges in Company Law – The Companies Act, 2013 – Law Notes

Introduction

The creditors of a company, for the purpose of securing the repayments of the loans from the debtor company, may require the debtor company to mortgage its immovable property. There is thus a relationship of creditor and debtor is established. Companies quite often have to create a charge on their immovable property by mortgaging it to obtain loan.

Section 2(16) of the Companies Act, 2013 defines charge as a “charge means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage.”

Difference between Charge & Mortgage :

A ‘mortgage’ is a transfer in the interest in specific immovable property for the purpose of securing payment of money advanced or to be advanced by way of loan. Whereas a ‘charge’ may be said to be a security given for securing loans by a mortgage on the assets of company.

There are two elements common in charge as well as mortgage. Firstly, there is bound to be a loan, and secondly, there is a security for repayment of loans.

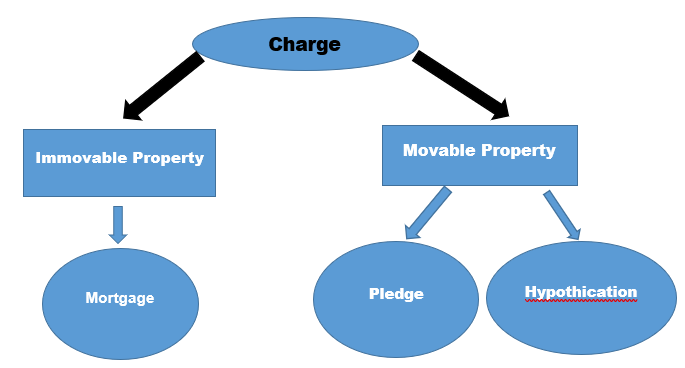

Charge is actually obstruction on the title of property. Once there is charge on the property, it can not be sold out or transferred. Based on the nature of the property, i.e movable or immovable, charge can be created by three ways.

Pledge : Pledge is defined to be a bailment of personal property as security for some debt.

Hypothication : It means a charge on any movable property created in favour of a secured creditor without delivery of possession of the movable property to such creditor.

Mortgage : It is charge created on immovable property.

Kinds of Charge :-

A charge on the property of the company as security for debenture or debt may be either i) a fixed charge or ii) a floating charge.

i) Fixed or Specific Charge :

The charge when made specifically to cover assets which are ascertainable and definite at the time of creating the charge eg land, building, etc., then it is called as a ‘Fixed or Specific Charge’. The company cannot dispose off the property temporarily during the period of charge. In case, the company goes in winding up, a debenture holder or a creditor secured by a fixed or specific charge shall be placed in the top priority of all creditors.

ii) Floating Charge :

A floating charge is not attached to any definite property but includes property which is in the nature of fluctuations eg stocks.

A floating charge is a security interest or lien over a group of non-constant assets that change in quantity and value.

Example of floating charge : XYZ incorporation is a super market. It takes loan from a bank on its inventory as collateral security. The bank has ownership of inventory or a floating charge.

The security of floating charge is it’s current assets where, company is allowed to use those assets for running the business.

Invalidity of floating charge : The Companies Act prevents an usecured creditor to get priority over other creditors by obtaining a floating charge when he learns that company is going to be wound up shortly. This provision has been made in section 332.

Section 332 of the Companies Act, 2013 provides that, Where a company is being wound up, a floating charge on the undertaking or property of the company created within the twelve months immediately preceding the commencement of the winding up, shall, unless it is proved that the company immediately after the creation of the charge was solvent, be invalid.

Floating charge is very useful to companies because it allows to use it’s present inventory, by keeping it as collateral security to get financial support.

Crystallisation of Floating Charge:

In general crystallisation means, solidification of a liquid substance and in law it means, ‘the process of a floating charge converting into a fixed charge when certain events occur.’

A floating charge generally remains dormant until it crystallises or become a fixed charge. A floating charge crystallises into a fixed security under the following circumstances.

(i) when company goes in liquidation

(ii) when company ceases to carry on business

(iii) when debenture holders or creditors takes step to enforce this security

(iv) on happening of an event specified in the deed.

Until a floating charge crystallises into a fixed one, the company can deal with the property so charged in any manner.

Bank of Baroda v. H. B. Shivdasani it was held that, where the company has transferred all its business and assets to the creditor, then in that case, there is nothing left to be called as ‘floating charge’ and as such charge immediately crystallises into a fixed charge.

Duty to Register Charges : Section 77 of the Companies Act requires a company to file within thirty days of the creation of a charge, with the Registrar of Companies, complete particulars. If not registered, the charge shall be void and the money secured thereby shall become immediately payable.

Register of Charges : Section 85 of the Companies Act requires every company to maintain a register of charges at its registered office and enter therein all charges affecting the property of the company and all floating charges on its undertaking. The Register of charge should be open for inspection to any creditor or member of the company without any fee.

The Registrar of Companies has also to maintain a Register of charges in respect of each company.