Introduction to Companies Act 2013 – Law Notes – Salient Features, Advantages & Disadvantages of forming a Company

What is the meaning of ‘Company’ ?

Oxford Dictionary :

— being with another or others

–people assembled

–people working together or united for business purpose.

Company is an association of persons formed for the purpose to achieve some common objects.

Section 3 (1) (i) of The Companies Act, 1956 :- ” company” means a company formed and registered under this Act or an existing company.

The Companies Act, 2013 : Section 2(20) : ―’Company’ means a company incorporated (समाविष्ट) under this Act or under any previous company law;

From Latin words :

The term ‘Company’ is derived from the Latin word “com” meaning “with” or “together”; “panis” that is “bread”. Together means Company is an association of person who takes their meals together.

Thus, in popular parlance, a company denotes an association of likeminded persons formed for the purpose of carrying on some business or undertaking.

A Company is a corporate (सामुदायिक / संयुक्त) body and a legal person having status and personality distinct and separate from the members constituting it.

Since a corporate body i.e. a company is the creation of law, it is not a human being, it is an artificial juridical person, i.e. created by law. It is clothed with many rights, obligations, powers and duties prescribed by law. It is called a ‘person’. Being the creation of law, it possesses only the powers conferred upon it by its Memorandum of Association which is charter of the Company. Within the limits of powers conferred by the charter it can do all acts as a natural person may do.

Evolution of Companies Act, 2013 :

Our Companies Acts have been modelled on the English Acts. The first Companies Act was passed in India in 1850. It provided for the registration of the companies and transferability of shares.

The Companies Act, 1956 was enacted with the object to amend and consolidate the law relating to companies. This Act provided the legal framework for corporate entities in India. The Companies Act, 1956 had undergone changes by several amendments. Major amendments were made through the Companies (Amendment) Act, 1988, and then again in 1998, 2000 and in 2002 through the Companies (Second Amendment) Act, 2002…….Finally, An Act to consolidate and amend the law relating to companies, “The Companies Act, 2013” was enacted, and subsequently, some more amendments were made through The Companies (Amendment) Act, 2015.

The Act consists of 470 sections with VII shedules.

(With section 2 providing 95 definitions)

CATHERINE LEE V LEE’S AIR FARMING LIMITED (1960)

In 1954 the appellant’s husband Lee formed the company named LEE’S AIR FARMING LTD. for the purpose of carrying on the business of aerial top-dressing with 3000 thousand share of 1euro each forming share capital of the company and out of which 2999 shares were owned by Lee himself.

He voted himself the managing director and got himself appointed by articles as chief pilot at a salary.

He exercised unrestricted power to control the affairs of the company and made all the decision relating to contracts of the company.

Company entered into various contract with insurance agencies for insurance of its employees and few premiums of the policies were paid through companies bank account for the personal policies taken by Lee in its own name.

Lee apart from being the director of the company was also a pilot. In March, 1956, Lee was killed while piloting the aircraft during the course of aerial top-dressing. Lee’s wife who is appellant claimed worker compensation under New Zealand Workers’ Compensation Act, 1922 as she claimed that Lee died during work as employee of the company.

Respondent company claimed that Lee was owner of the company and had maximum number of shares in the company so his wife is not entitled for workmen compensation as he was not the employee of the company. Respondent claimed that Mr. Lee couldn’t be the owner of the company as there is no master-servant relation that exist between him and the company.

“It was held that, Lee was a separate person from the company he formed and his widow was held entitled to get compensation. In effect the magic of corporate personality enabled him (Lee) to be the master and servant at the same time and enjoy the advantages of both.

Salient features and advantages of forming a Company :

(Nature and Characteristics of a Company)

Separate Legal Existence. ( Corporate personality) :

The outstanding feature of a company is its independent corporate existence. A company before the law is a person. It is regarded as an entity separate from its members. By incorporation under the Act, the company is vested with a corporate personality which is distinct from the members who compose it. No one can say that he is the owner of the company. Now the business belongs to an institution. Thus a company continues to exist even if the members go on changing from time to time.

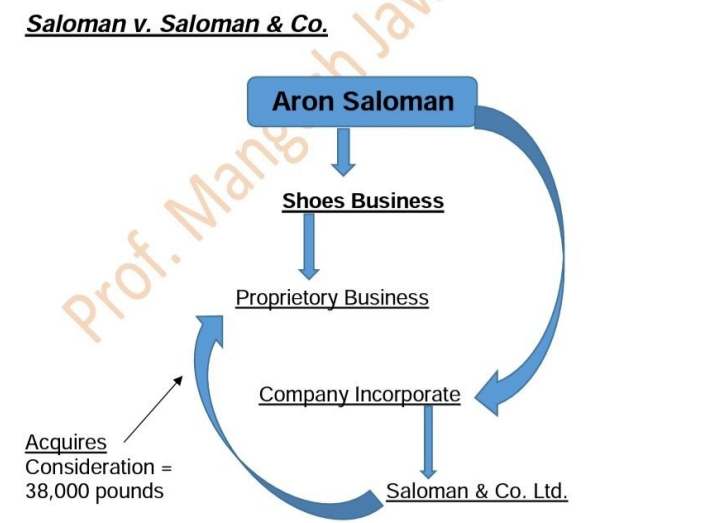

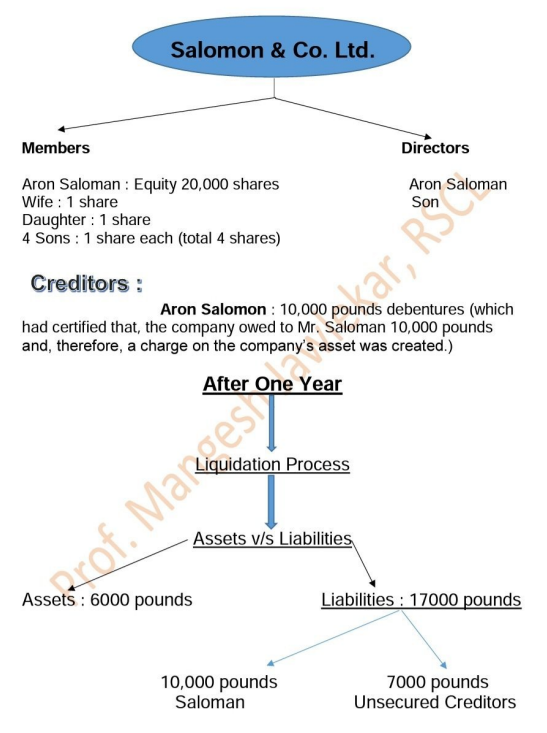

In the landmark decision of Salomon v Salomon (1897), it was held that a company has a corporate personality which is distinct from its members or subscribers. A single shareholder may virtually (अक्षरशः) hold the entire share capital of the company; even in such a case, the company does not lose its identity. It was declared that the business belonged to the company and not to a single shareholder or number of shareholders and neither of them is liable to indemnify the company for its debts.

Perpetual succession

An incorporated company never dies, except when it is wound up as per law. A company, being a separate legal person is unaffected by death or departure of any member and it remains the same entity, despite total change in the membership.

For understanding this point more clearly let’s assume M, N, and O are the only members of a company, holding all its shares. Their shares may be transferred to or inherited by P, Q, or R who may, therefore, become the new members and members of the company as they are now the shareholders of the company. But the company will remain the same entity, with same name, privileges and immunities, property and assets.

In the case of PNB v. Lakshmi Industrial & Trading Co. (P) Ltd.(2001), it was held by the Allahabad High court that, persons giving guarantee for co’s loan could not claim to be relieved of liability because the co’s management had totally changed including MD. Such changes does not effect the comtinuity of the co., or its commercial and contractual relations.

Perpetual succession means that membership of a company may keep on changing from time to time, but that does not affect the companies continuity.

Limited Liability of Members :

“The privilege of limited liability for business debts is one of the principal advantages of doing business under the corporate form of organization.”

A corporate form of business is far superior to- and much safer than that of a partnership firm as far as the monetary risk factor is concerned. A partner of a firm is personally liable for all the liabilities of the firm to an unlimited extent.

A company having its separate legal entity is the owner of its own assets and bound by its liabilities.

Members are neither the owner nor liable for its debts.

All the debts of a company are to be paid by itself rather than by its members. Members liability becomes limited or restricted to the nominal value of the shares taken by them in a company.

In other words, a shareholder is liable to pay the balance, if any due on the shares held by him, when called upon to pay and nothing more, even if the liabilities of the company far exceed its assets. This means that, the liability of a member is limited.

For example, if A holds shares of the total nominal value of Rs. 1,000 and has already paid Rs. 500/- as part payment at the time of allotment, he cannot be called upon to pay more than Rs. 500/-. If he holds fully-paid shares, he has no further liability to pay even if the company is declared insolvent.

No member is bound to contribute anything more than the nominal value of the shares held by them or guarantee given by them in case of winding up of the company.

Exceptions to the principle of limited liability :

Incorporation by furnishing false information.

According to section 7(7), (b) of the Act, tribunal may on an application made to it in regards to any fraudulent or false information being furnished by a company during its incorporation and on being satisfied with the same, direct that liability of the members of such company shall be unlimited.

Fraudulent conduct of business.

Under section 339(1), during the course of winding up a company if it appears that any business of a company is carried on with the intent to defraud creditors of the company or any other persons, the tribunal may on the application of the Official Liquidator or the Company Liquidator or any other creditor on being satisfied declare that any person who is or has been a director, manager or officer of the company or any other person knowing part of aforesaid business shall be personally responsible, without any limitation of liability.

Unlimited company.

When the company is incorporated under section 3(2)(c) of the Act as an unlimited company. Then as the name clearly suggests that the liability of its members will be unlimited.

Misleading prospectus.

As per section 35(3) companies act, where it is proved that a prospectus is issued with an intention to defraud or mislead an applicant for securities of a company or any other person for any fraudulent purpose, then every person who was a director at the time of issuance of such prospectus or has been named as director in the prospectus shall be personally responsible without any limitation of liability for all and any of the losses or damages.

Acceptance of deposit with a fraudulent intention.

As per section 75(1), when a company fails to repay the deposit or part thereof or any interest referred under section 74 within specified time and it is proved that deposit is accepted with the intent to defraud the depositors or for any fraudulent purpose, every officer of the company who was responsible acceptance of those deposits shall be liable of all or any of the losses or damages that may have been incurred by depositors.

- Actions to be taken in pursuance of inspector‘s report.

Section 224(5) : Where the report made by an inspector states that fraud has taken place in a company and due to such fraud any director, key managerial personnel, other officer of the company or any other person or entity, has taken undue advantage or benefit, whether in the form of any asset, property or cash or in any other manner, the Central Government may file an application before the Tribunal for appropriate orders with regard to disgorgement (a situation in which a person or organization is forced to pay back money that they have made in an illegal way) of such asset, property, or cash, as the case may be, and also for holding such director, key managerial personnel, officer or other person liable personally without any limitation of liability.

Transferability of shares :-

The capital of a company is divided into parts, called shares.

Section 44 companies act of the Act, declares that “the shares or debentures or any other interest of any member in a company shall be a movable property that can be transferred in the manner provided in the article of the company.”

(Articles of Association is a document containing all the rules and regulations that governs the company.)Thus incorporation of a company allows its member to sell their shares in an open market and to get back his investment without any hassle of withdrawing money from the company. This unique feature of incorporation provides liquidity to the investor and stability to the company. On the other hand in a partnership firm partners can’t sell their share in an open market except with unanimous consent of all the partners.

Capacity to sue and be sued :-

Being a body corporate company possesses individual capacity being sued and suing others in its own name. A company’s right to sue arises when some loss is caused to the company i.e. to property or personality of the company. A company also has a right to sue whenever any defamatory material published about it that may affect its business.

The criminal complaint can be filed by a company but it must be represented by a natural person. Not necessarily be represented throughout by the same person but the absence of such representative may result in dismissal of the complaint. Similarly, any default on the part of the company can be sued by the victim on the name of the company only.

Contractual Rights :-

A Company, can enter into contracts for the conduct of the business in its own name. A shareholder can not enforce a contract made by his company; he is neither a party to the contract, nor be entitled to the benefit derived from it as a company is not a trusty for its shareholders.

Common Seal :-

Though a company has an artificial personality, it acts through human beings, who are called as directors. They act as agents to the company but not to its members. All the acts of the company are authorized by its “common seal”. The “common seal” is the official signature of the company. A document not bearing the common seal of the company will not be binding on the company.

Separate property :-

A company being a legal person and entirely distinct from its members, is capable of owning, enjoying and disposing of property in its own name. The corporate property is clearly distinguished from the members’ property and members have no direct proprietary rights to the company’s property

It was held in R.F. Perumal v. H. John Deavin that, “no member can claim himself to be the owner of the company’s property during its existence or in its winding-up”.

Separate Management :-

The members may derive profits without being burdened with the management of the Company. They elect their representatives as Directors on the Board of Directors of the company to conduct corporate functions through managerial personnel employed by them.

Voluntary Association for Profit :-

A company is a voluntary association foor profit. It is formed for the accomplishment of some stated goals and whatsoever profit is gained is divided among its shareholders or saved for the future expansion of the company.

Termination of Existence :-

A company, being an artificial juridical person, does not die a natural death. Generally, the existence of a company is terminated by means of winding up. However, to avoid winding up, sometimes, companies adopt strategies like reorganisation, reconstruction and amalgamation.

To sum up,

“ A company is a voluntary association for profit with capital divisible into transferable shares with limited liability, having a distinct corporate entity with perpetual succession “.

Disadvantages of Incorporation

I) Lifting the Corporate veil :-

(Doctrine of Lifting of or Piercing (cut) the Corporate Veil)

Corporate Veil Meaning :- A Company is a person created by law, having a distinct entity. This principle is referred as Veil of Incorporation.

Misuse :- If the veil is used as a mask of fraud, then the courts will lift the veil and look at the person behind the company.

From the juristic point of view, a company is a legal person distinct from its members [Salomon v. Salomon and Co. Ltd.]. This principle may be referred to as the ‘Veil of incorporation’. The courts, in general, consider themselves bound by this principle. The effect of this Principle is that there is a fictional(काल्पनिक) veil between the company and its members. That is, the company has a corporate personality which is distinct from its members.

But, in a number of circumstances, the Court will pierce the corporate veil or will ignore the corporate veil to reach the person behind the veil or to reveal the true form and character of the concerned company. The rationale behind this is probably that the law will not allow the corporate form to be misused or abused. In those circumstances in which the Court feels that the corporate form is being misused, it will rip through the corporate veil and expose its true character and nature.

The circumstances under which the courts may lift the corporate veil may broadly be grouped under the following two heads :

-

- Under statutory provisions

- Under judicial interpretations.

A. UNDER STATUTORY PROVISIONS :-

The veil of corporate personality may be lifted in certain cases or pierced as express provisions of the Act. In other words, the advantage of ‘distinct activity’ and ‘limited liability’ may not be allowed to be enjoyed in certain circumstances. Such cases are :

Misrepresentation in Prospectus (Secs 34 & 35) :-

In case of misrepresentation in a prospectus, every director, promoter and every other person, who authorizes such issue of prospectus, incurs liability towards those who subscribed for shares on the faith of untrue statement.

Failure to Return Application Money (Sec 39) :- In case of issue of shares by a company to the public, if minimum subscription as stated in the prospectus has not been received within 30 days of the first issue of the prospectus the company must return the application money forthwith else the directors shall be personally liable to return the money along with prescribed interest.

Misdescription of Name (Sec 12) :-

Where an officer of a company signs on behalf of the company any contract, bill of exchange, hundi, promissory note, cheque or order for money, such person shall be personally liable to the holder if the name of the company is either not mentioned or is not properly mentioned

Holding Subsidiary Company :-

A holding company is required to disclose to its members the accounts of its subsidiaries. Every holding company shall attach to its balance sheet, copies of the balance sheet, profit and loss account, directors report and auditor’s report etc., in respect of each subsidiary company.

It amounts to lifting the corporate veil because in in the eyes of law a subsidiary is a separate legal person and through this mechanism their identity is known.

For Investigation of Ownership of Company (Sec 216) :-

Where it appears to the Central Government that there is a reason so to do, it may appoint one or more inspectors to investigate and report on matters relating to the company, and its membership for the purpose of determining the true persons—

(a) who are or have been financially interested in the success or failure, whether real or apparent, of the company; or

(b) who are or have been able to control or to materially influence the policy of the company.

Sometimes it becomes necessary to enquire into the ownership of shares and the extent of controlling interest as regards payment of taxes. The court has power to disregard corporate personality if it is used for tax evasion.

Fraudulent Conduct (Sec 339) :-

If in the course of the winding up of a company, it appears that any business of the company has been carried on with intent to defraud creditors of the company or any other persons or for any fraudulent purpose, the Tribunal, on the application of the Official Liquidator, or the Company Liquidator or any creditor or contributory of the company, may, if it thinks it proper so to do, declare that any person, who is or has been a director, manager, or officer of the company or any persons who were knowingly parties to the carrying on of the business in the manner aforesaid shall be personally responsible, without any limitation of liability, for all or any of the debts or other liabilities of the company as the Tribunal may direct.

Liability under this section may be imposed only if it is proved the business of the company has been carried on with a view to defraud its creditors.

Liability for Ultra Vires Acts :-

Directors and other officers of a corporate will be personally liable for all those acts which they have done on behalf of company if the same are ultra vires the company.

Liability under other Statutes :-

Besides the Companies Act, directors and other officers of the company may be held personally liable under the provisions of other statutes.

B. UNDER JUDICIAL INTERPRETATIONS :-

Some of the cases where the veil of incorporation was lifted by judicial decisions may be discussed to form an idea as to the kind circumstances under which the face of corporate personality will be removed.

Protection of Revenue :-

If a company is being used for tax evasion or to avoid tax liabilities, the court readily disregard the corpoarate form of the business entity and lift the veil to see the human beings behind the corporate mask, as in Re. Dinshaw Maneckjee Petit (1927)

Sir Dinshaw Petit was a rich man having dividend and interest income. He was assessed for super-tax on an aggregate income of Rs. 11,35,302 arising in the previous year. He wanted to avoid income-tax. For this purpose, he had formed four private companies, in all of which he was the majority shareholder. The companies made investments and whenever interest and dividend income were received by the companies, he applied to the companies for loans, which were immediately granted, and he never repaid. In a legal proceeding the corporate veil of all the companies were lifted and the income of the companies treated as if they were ofSir Dinshaw Maneckjee Petit.

Prevention of Fraud or Improper Conduct :-

Where the medium of a company has been used for committing fraud or improper conduct courts have lifted the veil and looked at the realities of the situation. (Jones v. Lipman).

Gilford Motor Co V. Horne (1933) :- Horne was appointed as a managing director of the plaintiff company on the condition that “he shall not at any time while he shall hold office of a managing director or afterwards, solicit or entice away the customer of the company”. His employment was determined under an agreement. Shortly afterwards he opened a business in the name of a company which solicited the plaintiff’s customer.

It was held that, the defendant company ought to be restrained as well as the defendant Horne.

Determination of character (Trading with the enemy) :-

Company being an artificial person cannot be an enemy or friend. However, during war it may become necessary to lift the corporate veil and see the persons behind as to whether they are enemies or friends. It is because, though a company enjoys a distinct entity, its affairs are essentially run by individuals (Daimler Co. Ltd. v. Continental Tyre & Rubber Co., 1916).

Formation of Subsidiaries to Act as an Agent :-

In Merchandise Transport Ltd v. British Transport Commission (1961), a transport company wanted to obtain licenses for its vehicles but it could not do so if it made the application in its own name. It therefore, formed a subsidiary company and the application for licenses was made in the name of the subsidiary. The vehicles transferred to the subsidiary, held, the parent and the subsidiary company were one commercial unit and the application for licenses was rejected.

In case of Economic Offences :-

In Santanu Ray v. Union of India (1988) it was held that in case of economic offences a court is entitled to lift the corporate entity and regard to the economic realities behind face.

Where Company is used to avoid Welfare Legislation :-

Where it was found that the sole purpose for the formation of the new company to use device (idea) to reduce the amount to be paid by way of bonus to workman. Supreme Court upheld the piercing of the veil to look at the real transaction. (The Workman Employed inAssociated Rubber Industries Ltd, Bhavnagar v. The Associated Rubber Industries Ltd. Bhavnagar, 1986)

Government Company :-

A government company is, after all, a distinct entity in the eyes of the law. Even if the company holds majority of shares, company itself is not ‘government’. Justice Krishna Iyer took the view that, if the corporate veil of such a company is lifted, what lies behind the veil is the government, against whom writ petitions can be entertained. (Som Prakash Rekhi v. Union of India, 1981).

II) Cost :–

The starting cost of incorporation comprises the fee needed to document our articles of incorporation, potential attorney or accountant fees, or the cost of using an incorporation administration to help us with completion and documenting the paperwork. There are additionally ongoing fees for keeping a corporation.

Even expenses involved in the incorporation of a company, in its day-to-day running and at the time of winding up are much greater than in the case of a partnership firm.

III) Formalities :-

Corporate law requires lot of formalities to be complied with.

Formalities start before the actual incorporation of a company, exist throught the life of company and continue even during its winding up.

IV) Ongoing Paperwork :-

Most corporations are needed to document annual reports on the financial status of the company. The ongoing administrative work additionally incorporates tax returns, bookkeeping records, meeting minutes and any necessary licenses and allows for conducting business.

V) Loss of Privacy :

In case of company, several documents including its accounts are to be filed with ROC and are open to public inspection resulting in loss of privacy after incorporation.

VI) Denial of fundamental rights :-

Some of the fundamentl rights of the Constitution of India are available only to citizens of India (i.e. human beings).

But after the R.C. Cooper v. UOI, 1970, the corporation can claim their fundamental rights through their shareholder, provided the shareholder is the citizen of India.

VII) Loss of Personal Ownership :–

If a corporation is a stock corporation, an individual doesn’t sustain full control of the entity. The corporation is controlled by a board of directors who are nominated by the shareholders.

Key Differences Between Partnership Firm and Company

- A partnership is an agreement between two or more persons who come together to carry out a business and share profit & losses mutually. A company is an incorporated association, also called an artificial person having a separate identity, common seal and perpetual succession.

- The registration of the partnership firm is not compulsory whereas to form a company; it needs to be registered.

- For the creation of a partnership, there must be at least two partners. For the formation of a company, there must be at least two members in case of private companies and 7 in regard to public companies.

- The limit for the maximum number of partners in a partnership firm is 100. On the other hand, the maximum number of partners in case of a public company is unlimited and in the case of a private company that limit is 200.

- The next major difference between them is, there is no minimum capital requirement for starting a partnership firm. Conversely, the minimum capital requirement for a public company is 5 lakhs and for a private company, it is 1 lakh.

- In the event of dissolution of the partnership firm, there are no legal formalities. In opposition to this, a company has many legal formalities for winding up.

- A partnership firm can be dissolved by any one of the partners. In contrast to this, the company cannot be wound up, by any one of the members.

- A partnership firm is not bound to use the word limited or private limited at the end of its name while a company has to add the word ‘limited’ if it is a public company and ‘private limited’ if it is a private company.

- The liability of the partners is unlimited whereas the liability of the company is limited to the extent of shares held by every member or guarantee given by them.

- A member of a company can contract with his company. A partner cannot contract with his firm.

- Member of a company are not its agents. Partners are the agents of the firm.

- Property of company belongs to the company and not to the members. In partnership the firm’s property is the property of its partners.

- Death of a member of a company has no effect on the company. But unless the partnership deed provides otherwise, death of a partner dissolves a firm.

- A company have a common seal where as law does not prescribe any seal for a partnership firm.

- Insolvency of a member of a company has no effect on the company. Whereas in partnership, unless the partnership deed provides otherwise, insolvency of a partner dissolves a firm.

- Governing Acts : The Companies Act, 2013 & The Indian Partnership Act, 1932.

- A company can raise public money by issuing a prospectus. A partnership firm cannot do so.

——————————————————————————————–

Distinction between Company and Hindu Undivided Family Business

1. A Hindu Undivided Family Business consists of homogenous (unvarying) members since it consists of members of the joint family itself whereas . A company consists of heterogeneous (varied or diverse) members.

2. A person becomes a member of a Hindu Undivided Family business by virtue of birth. There is no provision to that effect in the company. A person becomes member of a company by acquiring share and whose name is entered in the registere of members.

3. No registration is compulsory for carrying on business for gain by a Hindu Undivided Family. Registration of a company is compulsory.

4. In a Hindu Undivided Family business the Karta (manager) has the sole authority to contract debts for the purpose of the business, other coparceners cannot do so. There is no such system in a company.

5. In the company, profit is distributed according to the number of shares of the members. In Joint Hindu Family Business, distribution of profit is equal in all members.

The Registrar Of Companies (ROC)

Sec 2(74) :― “register of companies” means the register of companies maintained by the Registrar on paper or in any electronic mode under this Act;

Sec 2(75) :― “Registrar” means a Registrar, an Additional Registrar, a Joint Registrar, a Deputy Registrar or an Assistant Registrar, having the duty of registering companies and discharging various functions under this Act;

The ROC is the primary regulatory authority of companies registered under the Companies Act, 2013. The Registrar of Companies ( ROC ) is an office under the Ministry of Corporate Affairs (MCA), which is the body that deals with the administration of companies in India. At present, around 25 Registrar of Companies (ROCs) is operating in all the major states/UT’s.

However, states like Tamil Nadu and Maharashtra, have more than one ROC. As per section 609 of the Companies Act, 1956, the ROCs are tasked with the principal duty of registering the companies across the states and the union territories. Currently, after the introduction of Companies Act, 2013, the same powers conferred under section 609 is provided under section 396 of the Companies Act, 2013 to the ROCs.

Registrar of Companies maintains a registry of records concerning companies which are registered with them and allows the general public in accessing this information on payment of a stipulated fee. The Central Government preserves administrative control over the Registrar of Companies with the help of Regional Directors.

Functions of ROC :-

* The ROC takes care of registration of a company (also referred to as incorporation of the company) in the country.

* It completes regulation and reporting of companies and their shareholders and directors and also administers government reporting of several matters which includes the annual filing of numerous documents.

* The Registrar of Companies plays an essential role in fostering and facilitating business culture.

* Every company in the country requires the approval of the ROC to come into existence. The ROC provides an incorporation certificate which is conclusive evidence of the existence of any company. A company, once incorporated, cannot cease unless the name of the company is struck off from the register of companies.

* Among other functions, it is worthy to note that the Registrar of Companies could also ask for supplementary information from any company. It could search its premises and seize the books of accounts with the prior approval of the court.

* Most importantly, the Registrar of Companies could also file a petition for winding up of a company.

Companies are registered by ROC :-

No company can come into existence by itself. It requires a certificate of incorporation issued by the Registrar of Companies after the finalization of several statutory requirements. As part of the statutory process, the promoters need to submit several documents to the Registrar of Companies.

After authenticating the documents, the ROC inputs the company’s name in the register of companies and releases the certificate of incorporation. The Registrar together with the certificate of incorporation also issues a certificate of commencement of business.

ROC can say ‘no’ to registering company :-

ROC can refuse to register a company on various grounds. The registrar needs to ensure that no registration is allowed for companies having an objectionable name. The registrar could also decline to register any company which has unlawful objectives.

Filing resolutions with ROC :-

A company is required to intimate the Registrar of Companies concerning all of its activities which includes appointing directors or managing directors, issuing prospectus, appointing sole-selling agents, or the resolution regarding voluntary winding up, etc.