Incorporation of Company ,ROC & Promoters – The Companies Act, 2013 – Law Notes

The Registrar Of Companies (ROC)

Sec 2(74) :― “Register of companies” means the register of companies maintained by the Registrar on paper or in any electronic mode under this Act;

Sec 2(75) :― “Registrar” means a Registrar, an Additional Registrar, a Joint Registrar, a Deputy Registrar or an Assistant Registrar, having the duty of registering companies and discharging various functions under this Act;

The ROC is the primary regulatory authority of companies registered under the Companies Act, 2013. The Registrar of Companies ( ROC ) is an office under the Ministry of Corporate Affairs (MCA), which is the body that deals with the administration of companies in India. At present, around 25 Registrar of Companies (ROCs) is operating in all the major states/UT’s.

However, states like Tamil Nadu and Maharashtra, have more than one ROC. As per section 609 of the Companies Act, 1956, the ROCs are tasked with the principal duty of registering the companies across the states and the union territories. Currently, after the introduction of Companies Act, 2013, the same powers conferred under section 609 is provided under section 396 of the Companies Act, 2013 to the ROCs.

Registrar of Companies maintains a registry of records concerning companies which are registered with them and allows the general public in accessing this information on payment of a stipulated fee. The Central Government preserves administrative control over the Registrar of Companies with the help of Regional Directors.

Functions of ROC :-

* The ROC takes care of registration of a company (also referred to as incorporation of the company) in the country.

* It completes regulation and reporting of companies and their shareholders and directors and also administers government reporting of several matters which includes the annual filing of numerous documents.

* The Registrar of Companies plays an essential role in fostering and facilitating business culture.

* Every company in the country requires the approval of the ROC to come into existence. The ROC provides an incorporation certificate which is conclusive evidence of the existence of any company. A company, once incorporated, cannot cease unless the name of the company is struck off from the register of companies.

* Among other functions, it is worthy to note that the Registrar of Companies could also ask for supplementary information from any company. It could search its premises and seize the books of accounts with the prior approval of the court.

* Most importantly, the Registrar of Companies could also file a petition for winding up of a company.

Companies are registered by ROC :- No company can come into existence by itself. It requires a certificate of incorporation issued by the Registrar of Companies after the finalization of several statutory requirements. As part of the statutory process, the promoters need to submit several documents to the Registrar of Companies.

After authenticating the documents, the ROC inputs the company’s name in the register of companies and releases the certificate of incorporation. The Registrar together with the certificate of incorporation also issues a certificate of commencement of business.

ROC can say ‘no’ to registering company :- ROC can refuse to register a company on various grounds. The registrar needs to ensure that no registration is allowed for companies having an objectionable name. The registrar could also decline to register any company which has unlawful objectives.

Filing resolutions with ROC :- A company is required to intimate the Registrar of Companies concerning all of its activities which includes appointing directors or managing directors, issuing prospectus, appointing sole-selling agents, or the resolution regarding voluntary winding up, etc.

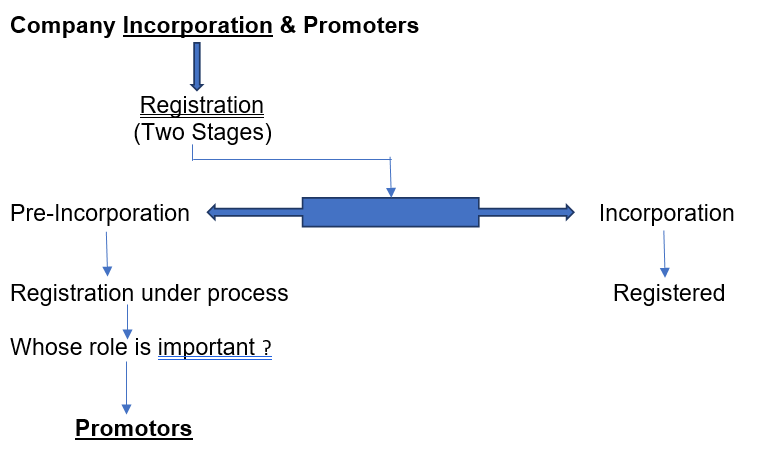

Registration and Incorporation of a Company

Section 3 of the Companies Act,2013 lays down the procedure for the formation of a Company.

(Who can form a company ? and for what purpose ?)

A company may be formed for any lawful purpose by—

(a) seven or more persons, where the company to be formed is to be a public company;

(b) two or more persons, where the company to be formed is to be a private company; or

(c) one person, where the company to be formed is to be One Person Company that is to say, a private company,

(How ?)

By subscribing their names or his name to a memorandum and complying with the requirements of this Act in respect of registration and submitting an application to the ROC of the State in which the registered office of the company is to be situated.

(It is crucial to know the meaning of “subscriber” in the context of the company before the incorporation. It helps to form the proper team of promoters and first investors of the company.

A Subscriber means any person who subscribes the share of the company when the company is incorporated. They are the first shareholders of the company. The details of subscribers are mentioned in the MOA and AOA of the company. Thus they are also known as the subscriber to memorandum of association.)

Promotors

Promotor is “one who undertakes to form a company with reference to a given project and to set it going, and who takes the necessary steps to accomplish that purpose”.

Promotor—Definition : Section 2(69)

“Promotor”means a person :-

P (a) who has been named as such in a prospectus or is identified by the company in the annual return referred to in section 92; or

C (b) who has control over the affairs of the company, directly or indirectly whether as a shareholder, director or otherwise; or

A (c) in accordance with whose advice, directions or instructions the Board of Directors of the company is accustomed(habitual) to act.

Provided that nothing in sub-clause (c) shall apply to a person who is acting merely in a professional capacity; (eg : agent/advocate/CA/CS)

Sec 2(27) ―”control” shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert(assemble), directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner;

Who can be Promoter ?

Any of the following may be Promotor

-

- Individual

- Corporte

- Syndicate

- Association of Persons

- Partnership

A promoter may be a natural person or a company.

The word “promoter” means the one who has taken all the necessary steps to create and mould a company and set it going.

The promoter originates the scheme for the formation of a company; gets together the subscribers to the memorandum, gets the Memorandum and Articles prepared, executed and registered, find bankers, brokers and legal advisers, finds the first directors, settles the terms of preliminary contracts with vendors and makes agreement for preparation, advertisement and circulation of the prospectus and placement of the capital.

Contracts with Promotor’s during Incorporation-Position as per Company Law :

As regards ratification of promoter’s contract, the view taken in Kelner v. Baxter was that the company could not ratify contract made by a promoter before its incorporation.

The Specific Relief Act, 1963 : Sec15 : Who may obtain specific performance :

S. 15 (h) when the promoters of a company have, before its incorporation, entered into a contract for the purposes of the company, and such contract is warranted by the terms of the incorporation, the company

PROVIDED that the company has accepted the contract and has communicated such acceptance to the other party to the contract.

Section 19 of the same Act provides that, the other party can also enforce the contract if the company has adopted it after incorporation and the contract is within the terms of the incorporation.

D.R. Patil v. A.S. Dimilov : A promoter is personally liable to third parties upon all contracts made on behalf of the intended company, until with their consent, the company takes over this liability.

If the promoter commits a breach of duties, the company can either rescind the contract or can compel him to account for any secret profits that he has made.

Legal Position of a Promoter :-

A promoter is neither an agent of, nor a trustee for, the company and therefore requires to make full disclosure of the relevant facts, including any profit made by him.

They have in their hands the creation moulding of the company. They have the power of defining how and when and in what shape and under whose supervision it shall come into existence and begin to act.

A Promoter cannot make secret profits from the Company, whether directly or indirectly. The promoters can be compelled to surrender the secret profits.

Duties of Promotor

1. Duty of Disclosure (Section 102(4)) :-

A promotor is duty bound to disclose all material facts to the Company. The promotor is under fiduciary relation with the company.

Section 102(4) :- Where as a result of the non-disclosure or insufficient disclosure in any statement being made by a promoter, director, manager, if any, or other key managerial personnel, any benefit which accrues to such promoter, director, manager or other key managerial personnel or their relatives, either directly or indirectly, the promoter, director, manager or other key managerial personnel, as the case may be, shall hold such benefit in trust for the company, and shall, without prejudice to any other action being taken against him under this Act or under any other law for the time being in force, be liable to compensate the company to the extent of the benefit received by him.

Penalty for non compliance (Section 102(5)) :- If any default is made in complying with the provisions of this section, every promoter, director, manager or other key managerial personnel who is in default shall be punishable with fine which may extend to fifty thousand rupees or five times the amount of benefit accruing to the promoter, director, manager or other key managerial personnel or any of his relatives, whichever is more.

The above provision is based on the principle that a promotor cannot make either directly or indirectly, any profit at the expenses of the company he promotes.

2. Not to make Secret Profits from Company :-

A promotor is not allowed to derive a profit from the sale of his own property to the company unless all material facts are disclosed.

In case, therefore, the promotor wishes to sell his own property to the company, he should either disclose the fact

3. Duty to utilise money raised from Public only for the objects such funds were raised ( Section 13(8)) :-

A company, which has raised money from public through prospectus and still has any unutilised amount out of the money so raised, shall not change its objects for which it raised the money through prospectus unless a special resolution is passed by the company and—

(i) the details, as may be prescribed, in respect of such resolution shall also be published in the newspapers (one in English and one in vernacular language) which is in circulation at the place where the registered office of the company is situated and shall also be placed on the website of the company, if any, indicating therein the justification for such change;

(ii) the dissenting shareholders shall be given an opportunity to exit by the promoters and shareholders having control in accordance with regulations to be specified by the Securities and Exchange Board.

4. Duty towards dissenting shareholders (Section 27(2)) :-

The dissenting shareholders being those shareholders who have not agreed to the proposal to vary the terms of contracts or objects referred to in the prospectus, shall be given an exit offer by promoters or controlling shareholders at such exit price, and in such manner and conditions as may be specified by the Securities and Exchange Board by making regulations in this behalf.

5. Duty to Appointing Directors in Company (Section 168(3)) :-

Where all the directors of a company resign from their offices, or vacate their offices under section 167, the promoter or, in his absence, the Central Government shall appoint the required number of directors who shall hold office till the directors are appointed by the company in general meeting.

6. Duty to extend co-operation to Company (Section 284(1)) :-

The promoters, directors, officers and employees, who are or have been in employment of the company or acting or associated with the company shall extend full cooperation to the Company Liquidator in discharge of his functions and duties. (punishable on failing, without reasonable cause, to discharge his obligations.)

Remedies available to Company against Promoter :

If the Company promoter acts against its duties, the Companies Act provides some remedies to Companies against the promoters. Those remedies are:-

Rescission of Contract

Recovery of secret profits

Suit against promoter

Cancel right of receiving remuneration by the promoter

Liabilities of Promoter

1. Incorporation of company by furnishing false information : (Section 7(6)) :

At any time after the incorporation of a company, if it is proved that the company has been got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company, or by any fraudulent action, the promoters, the persons named as the first directors of the company and the persons making declaration shall each be liable for action under section 447.

2. Liability for Non Compliance in Prospectus (Section 26) :

If a prospectus is issued in contravention of the different provisions of this section26, the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to three lakh rupees and every person who is knowingly a party to the issue of such prospectus shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than fifty thousand rupees but which may extend to three lakh rupees, or with both.

Further, the sources of promoter’s contribution are required to be disclosed in the prospectus in ssuch manner as may be prescribed.

3. Criminal Liability for misstatement in prospectus (Section 34) :-

The promoters are criminally liable under section 34 for the issue of prospectus containing untrue or misleading statements if it is likely to mislead. A promoter may be imprisoned for a term which shall not be less than six months to ten years and a fine which shall not be less than the amount involved in the fraud. Further, where the fraud in question involves public interest, the term of imprisonment shall not be less than three years.

But, if he proves that such statement or omission was immaterial or that he had reasonable grounds to believe, and did up to the time of issue of the prospectus believe, that the statement was true or the inclusion or omission was necessary.

4. Civil Liability for misstatement in prospectus (Section 35) :-

Where a person has subscribed for securities of a company acting on any statement included, or the inclusion or omission of any matter, in the prospectus which is misleading and has sustained any loss or damage as a consequence thereof, the company and every person as mentioned in the said section, including a promoter of the company, shall be liable to pay compensation to every person who has sustained such loss or damage.

When promoter not liable under this clause : A promoter is not liable if he proves that, the prospectus was issued without his knowledge or consent, and that on becoming aware of its issue, he forthwith gave a reasonable public notice that it was issued without his knowledge or consent.

5. Liability for Breach of Duty or Deceit (Section 340) :-

A promoter is liable for deceit or breach of duty if he has misapplied or retained any money or property of the company or is guilty of misfeasance (गैरवर्तन) or breach of trust in relation to the company.

6. Liability of promoters at the time of winding-up (Section 300) :-

Where an order has been made for the winding up of a company by the Tribunal, and the Company Liquidator has made a report to the Tribunal under this Act, stating that in his opinion a fraud has been committed by any person (including promoter) in the promotion, formation, business or conduct of affairs of the company since its formation, the Tribunal may, after considering the report, direct that such person or officer or promoter shall attend before the Tribunal, and be examined.

7. Promoters, directors, etc., to cooperate with Company Liquidator (Section 284) :-

(1) The promoters, directors, officers and employees, who are or have been in employment of the company or acting or associated with the company shall extend full cooperation to the Company Liquidator in discharge of his functions and duties.

(2) Where any person, without reasonable cause, fails to discharge his obligations under sub-section (1), he shall be punishable with imprisonment which may extend to six months or with fine which may extend to fifty thousand rupees, or with both.

8. Liability during Revival and Rehabilitation of companies

Section 257(3) : The interim administrator shall appoint a committee of creditors. The interim administrator may direct any promoter, director or any key managerial personnel to attend any meeting of the committee of creditors and to furnish such information as may be considered necessary by the interim administrator.

Section 266(2) : If the Tribunal is satisfied on the basis of the information and evidence in its possession with respect to any person who is or was a director or an officer or other employee of the sick company, that such person by himself or along with others had diverted the funds or other property of such company for any purpose other than the purposes of the company or, had managed the affairs of the company in a manner highly detrimental to the interests of the company, the Tribunal shall, by order, direct the public financial institutions, scheduled banks and State level institutions not to provide, for a maximum period of ten years from the date of the order, any financial assistance to such person or any firm of which such person is a partner or any company or other body corporate of which such person is a director, by whatever name called, or to disqualify the said director, promoter, manager from being appointed as a director in any company registered under this Act for a maximum period of six years.

Right to receive remuneration and preliminary expenses.

In absence of any agreement with the company a promoter cannot claim any remuneration for his services from the company. However if there is an agreement regarding promotor’s remuneration between him and company, the promoter has a right to get the remuneration.

The promoters have right to receive the expenses incurred in formation and registration of the company as provided in the articles.

The article posted was very informative and useful. You people are doing a great job. Keep going.